Introduction

Tax codes in a tax system are alphanumeric designations used to classify different types of taxes or tax-related transactions. They serve as identifiers for specific tax categories or regulations within a tax system. Tax codes are typically defined and maintained by tax authorities or government agencies responsible for taxation.

With BizGaze’s “Tax Codes” app, customers and organizations benefit from enhanced tax compliance, streamlined tax processes, accurate tax calculations, and improved financial management. The app simplifies tax-related tasks, reduces the risk of errors, and facilitates efficient tax planning and reporting.

Stage Workflow

| Stage Name | Description |

| Active | The tax code is currently in use and actively applied within the tax system |

| Inactive | Temporarily not in use or suspended, but it can be reactivated if needed |

| Deleted | The tax code has been permanently removed or deleted from the tax system and can no longer be used |

Portlets & Widgets

In the layout view, a Portlet accurately represents each functionality, and its corresponding data is precisely viewed as a Widget. The following section includes the default portlets and widgets of the Tax Codes App.

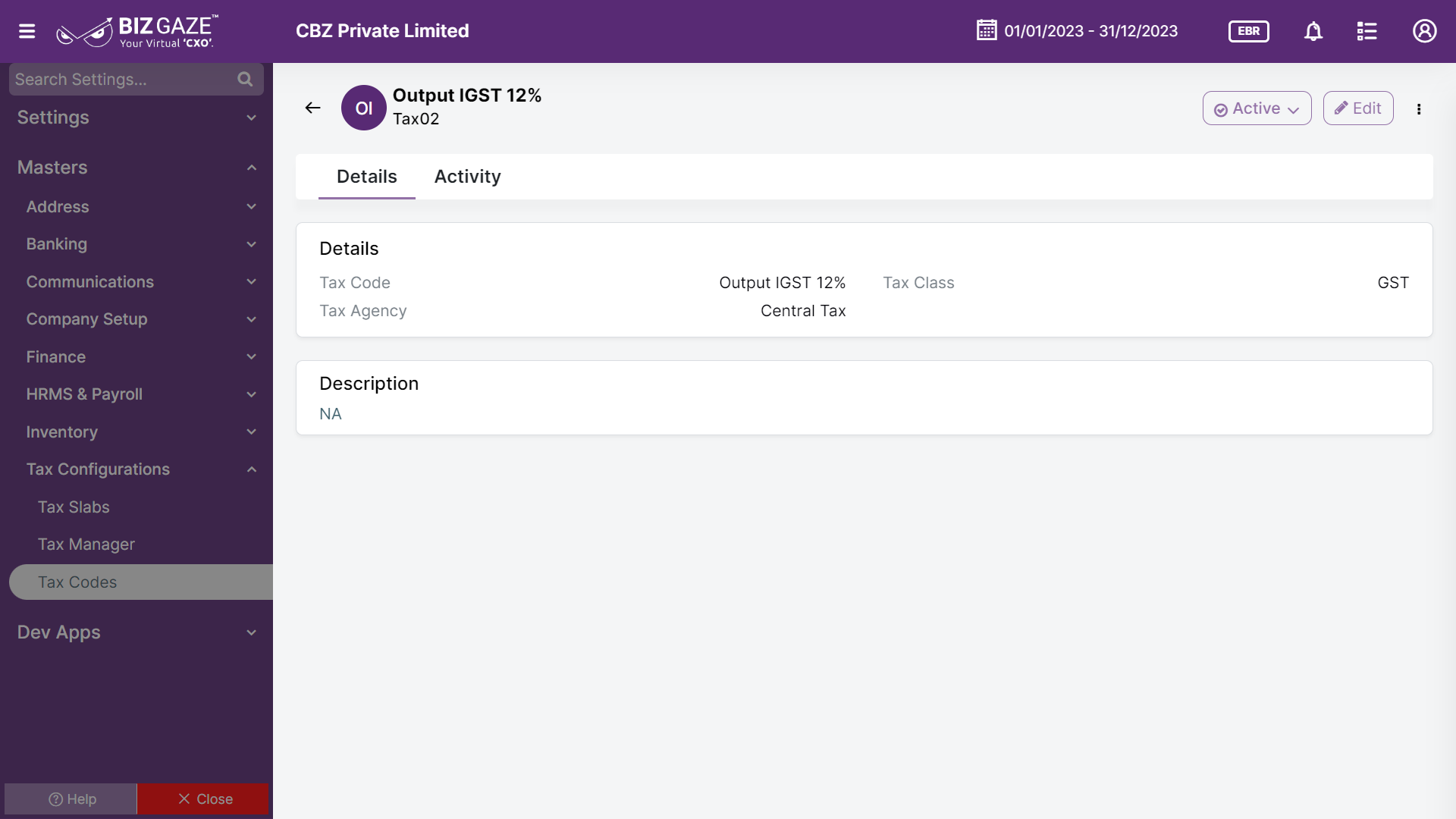

Details

This widget contains the basic details and Tax details of the Tax Code

| Field name | Description |

| Tax Code | Displays the name of the Tax Code. A tax code is a unique identifier or alphanumeric representation assigned to specific tax categories or regulations within a tax system and helps classify different types of taxes |

| Tax Class | Displays the name of tax class applied. A tax class is a collection of tax rates. Tax classes determine the tax rates that apply to menu items and service charges, and which tax rates can be reduced by discounts. |

| Tax Agency | Tax Agency name is displayed. Tax Agency is a revenue service, revenue agency or taxation authority of the government responsible for the intake of government revenue, including taxes and sometimes non-tax revenue |

| Description | Comments or short notes about the Tax Code are displayed |

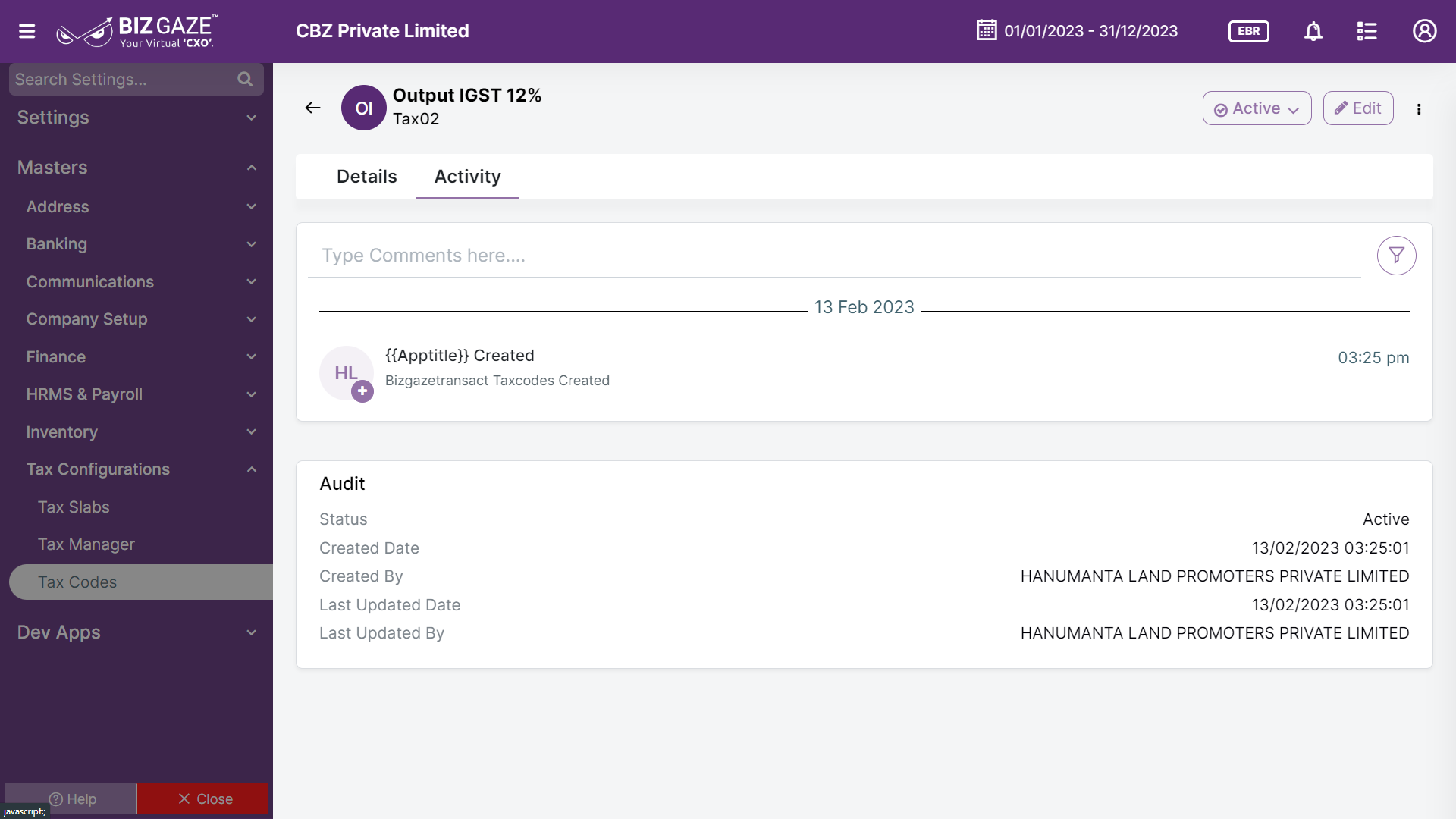

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Field Name | Field Description |

| Comments | User can write short notes or comments about the Tax Code |

| Audit | |

| Created Date | Date when the Tax Code is created |

| Created By | Name of the person who created the Tax Code |

| Last updated date | Last stage changed of the Tax Code |

| Last updated by | Name of the person who last updated the stage |

| Status | Displays the current status of the Tax Code |

| Time-Line | This widget tracks all the activities within the app. |

Reports

A report is a document that presents information in an organized format for a specific audience and purpose. Although summaries of reports may be delivered orally, complete reports are almost always in the form of written documents.

- Tax Codes Masters