Debit Note can be generated from 3 Apps

1. Debit Note App

2. Purchase Invoice App

3. Offers App

Debit Note App

The creation process of Debit Notes from the Debit Notes app is as follows:

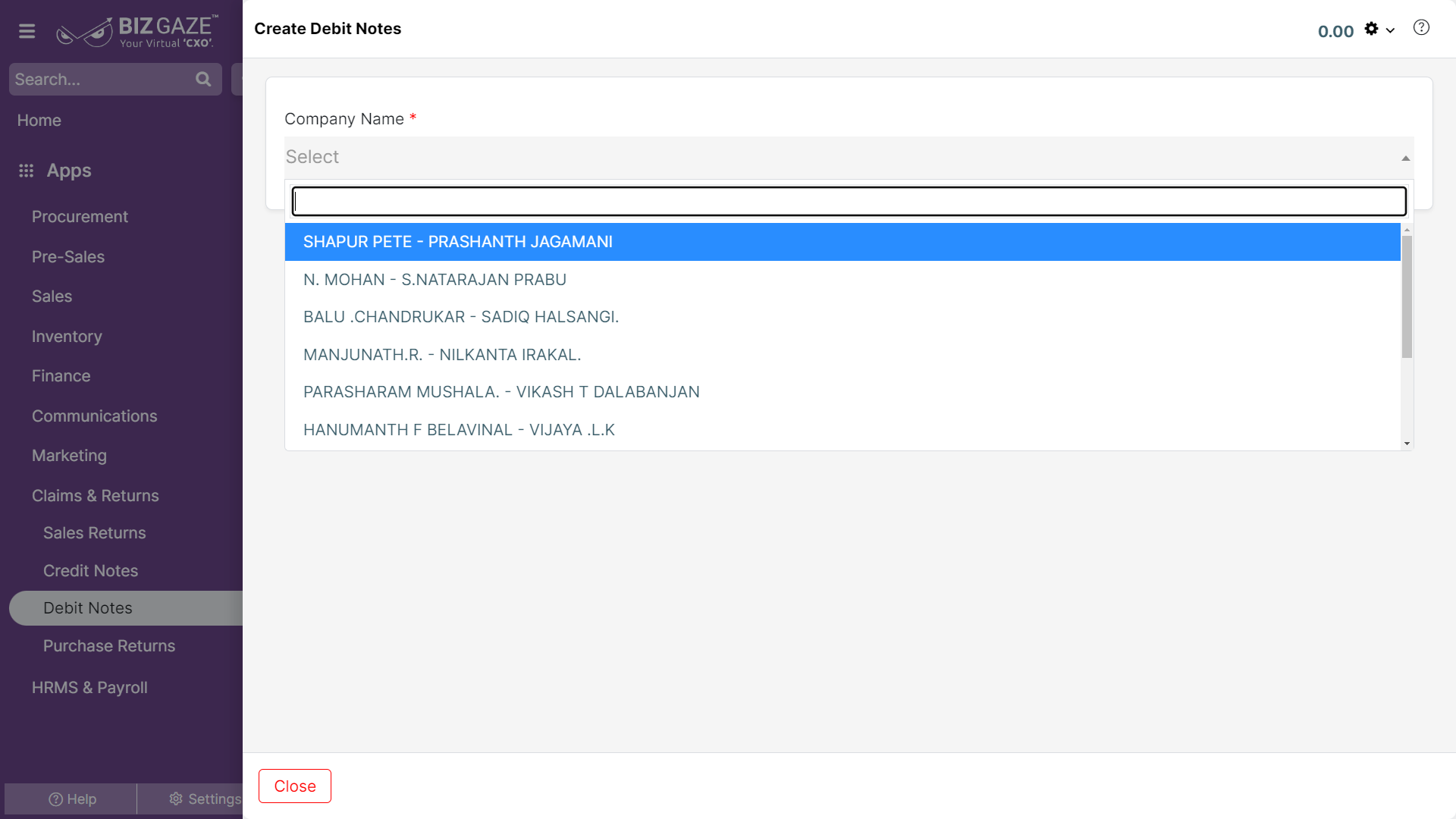

Navigation: Menu > Debit Note App > List View > Create(+)

| Company Name | Select the company name from the drop-down list. | Yes |

Note: Star(*) marked fields are mandatory!

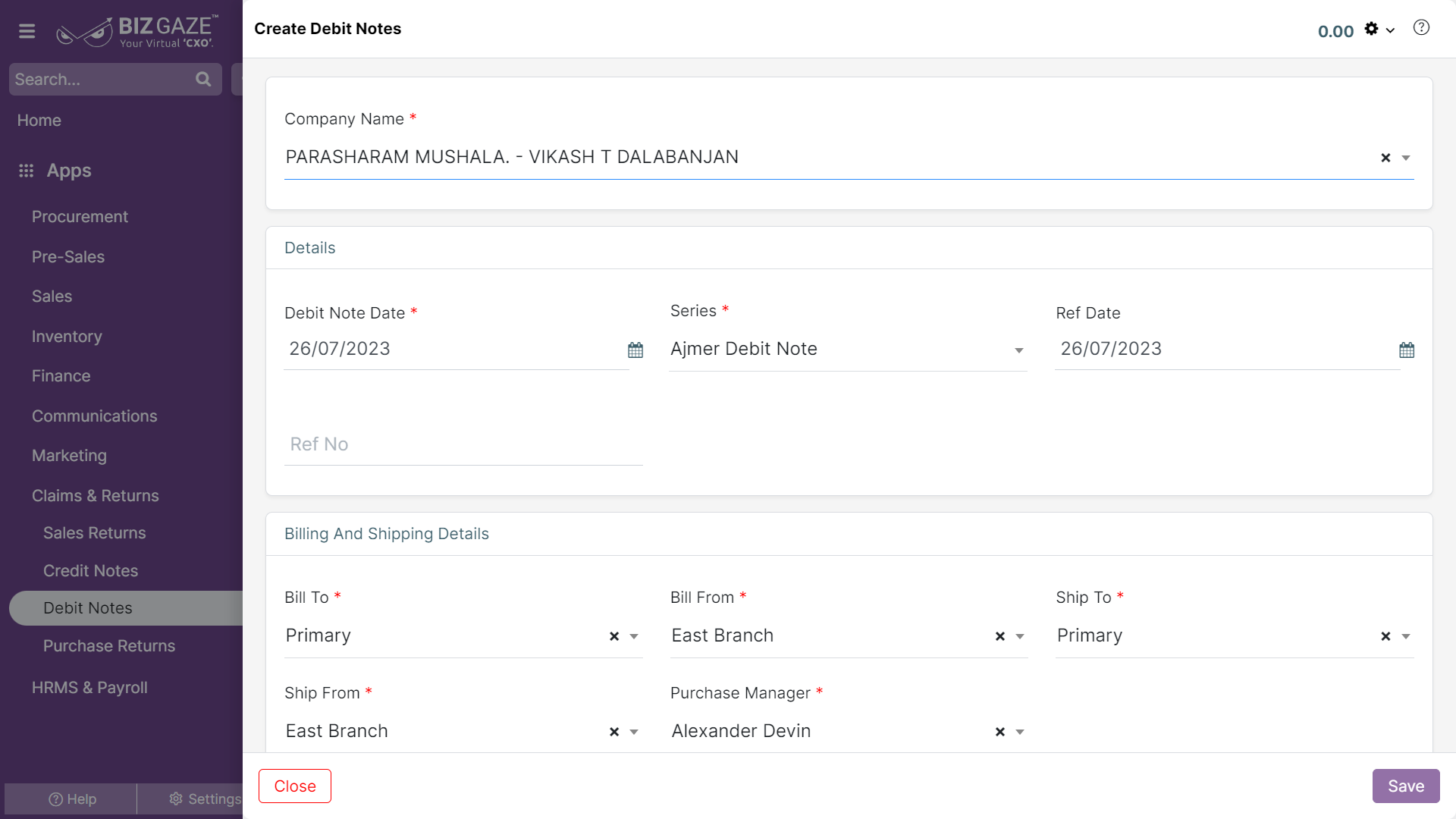

Note: System automatically picks up the basic details!

| Field Name | Field Description | Mandatory |

| Details | ||

| Invoice Date | Select Invoice Date from the calendar for the debit note. | Yes |

| Due Date | Select due date from the calendar. | Yes |

| Series | Select series from the drop-down list. | Yes |

| Ref Date | Select reference date from the calendar for the debit note. | No |

| Ref No | Enter reference number of your invoice for the debit note. | No |

| GST Number | Enter GST number | No |

| Exclude From Campaign | By changing the switch from red to green the invoice will be calculated in the campaign. | No |

| Billing and Shipping Details | ||

| Bill To | Select Bill To address from the down down list. | Yes |

| Bill From | Select Bill From address from the down down list. | Yes |

| Waybill No | User can enter the E-way bill no, its increase more than Rs. 50000/- | No |

| Ship To | Select Ship To address from the list drop-down list. | Yes |

| Ship From | Select Ship From address from the list drop-down list. | Yes |

| LoB | Select Line of Business segment from the drop-down list | Yes |

| Sales Person | Select Sales Person name from the drop-down list. | Yes |

| Payment Term | Select Payment Term days from the drop-down list. | Yes |

| More Options | By clicking on more options user can view the following details Payment Type: User can select the payments from the drop-down list in the order. Tax Type: User can select the tax type from the drop-down list to the order. |

|

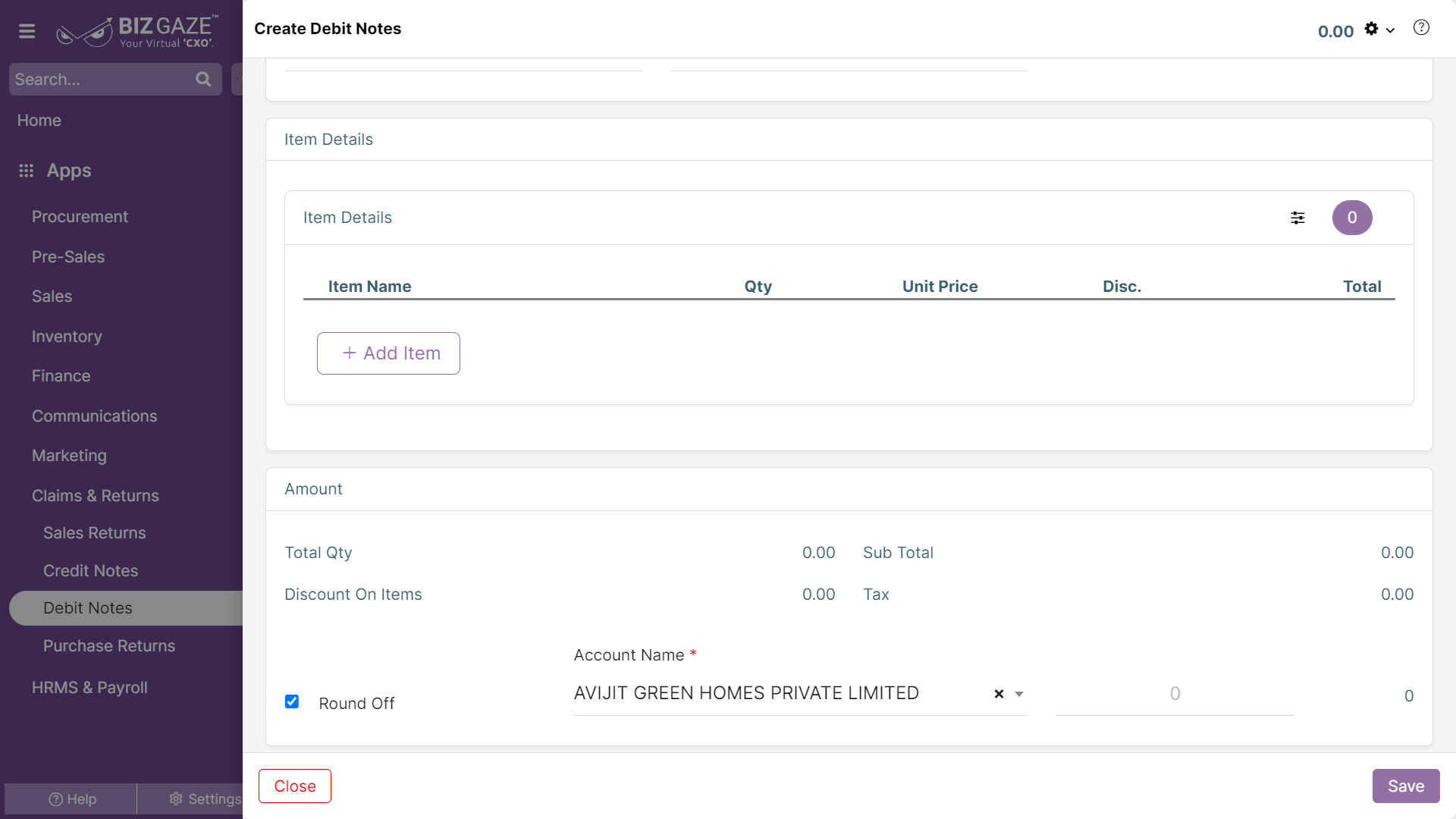

| Item Details | ||

| Add items: Click adds items to select the items | ||

| Select | Select name of the item from the list. | Yes |

| Qty(Quantity) | Enter number of items (quantity) to be returned | Yes |

| Unit Price | Price of the item is automatically generated by the system or user can manually enter the value | Yes |

| Disc.(Discount) | Select discount type from the drop-down and enter the value. | No |

| Add Discount Item: User can click Add discount item to select the items | ||

| Select | Select name of the item from the list. | No |

| Description | Enter description for the item. | No |

| Value | Enter value of the item. | No |

| Amount | ||

| Total Qty | Total quantity of the items in the debit note | |

| Sub Total | Value of the item on debit note | |

| Discount On Items | Discount value given in the debit note | |

| Tax | The value of taxes on total items | |

| Add Expense | By clicking on add expense, user can view the following fields Select Expense: Select the expense name from the drop down list. Description: Enter description for the expense. Value: Enter value of the expense. |

|

| Adjustment | When a user enables the “Adjustment” checkbox, the system automatically adjusts the value to the nearest decimal. If the users click on the checkbox, users can manually enter the values | |

| Account Name (Ledger Name) | Select account name from the list of the ledger account that the value has to be adjusted | Yes |

| Value | Enter the adjusted value | Yes |

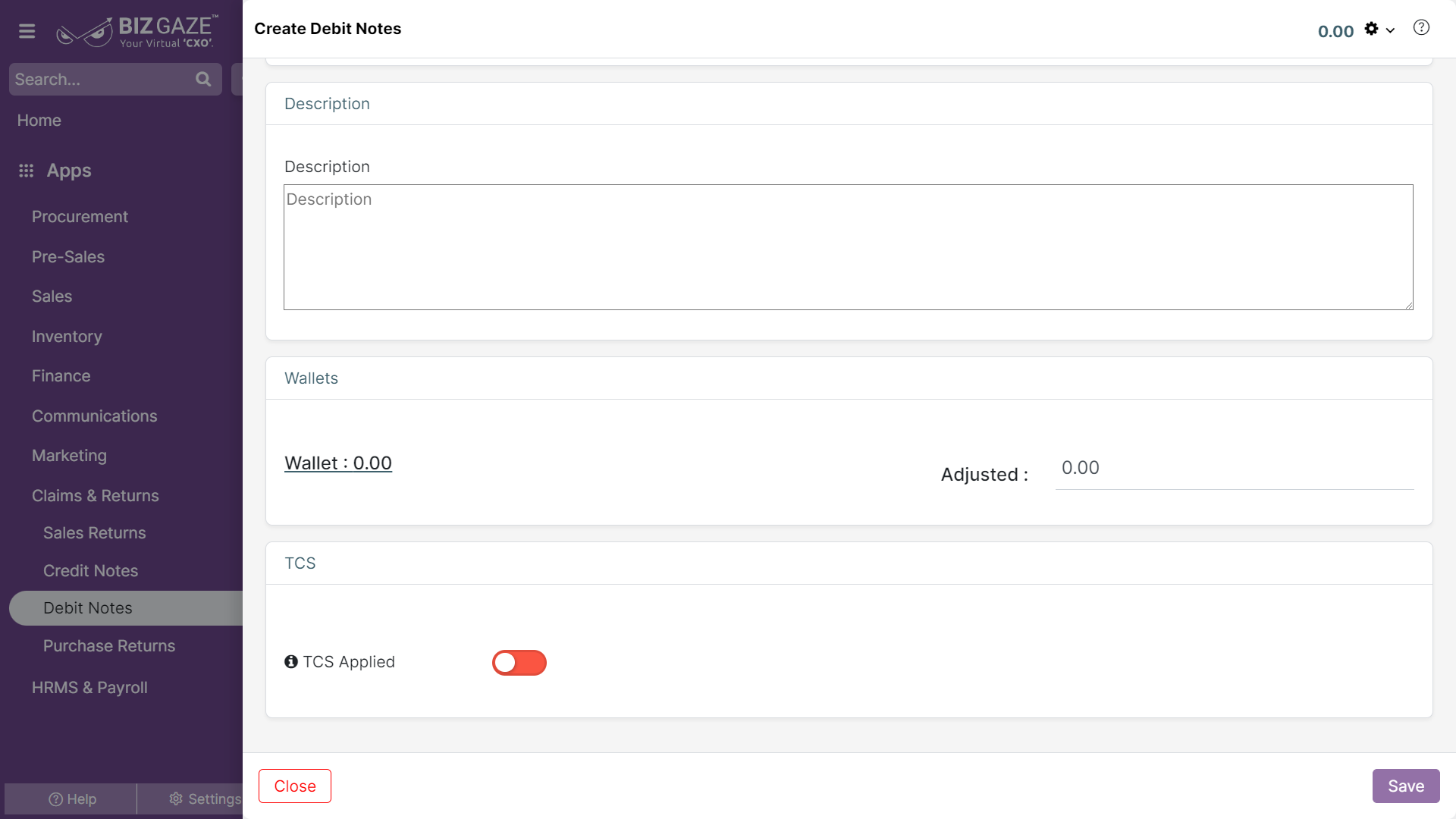

| Description | ||

| Description | Enter a short notes or comments for the debit note | No |

| TCS | |

| TCS Applied | User can click on the Toggle to apply the TCS (Tax Collected at source). The Toggle turns to green in color when enabled and red when disabled. |

| Wallets | |

| Adjustment | By tick mark the check box, the system automatically adjusts the amount to the decimal value or by Opting the check box user can enter manually. |

| Account Name | The user can select the account name from the dropdown list for the adjusted amount. |

Apply all the required details and click on save.

Purchase Invoice App

Navigation: Menu > Purchase Invoice App > List View > Select Record > More(Down Arrow) > Create Return

Note: System automatically pick up the invoice details!

The user needs to change the return quantity of the invoice and click on save.

Offers App

Navigation: Menu > Offers App > List View > Select the Campaign > Down Arrow > Finalize

Note: Star(*) marked fields are mandatory!

| Field Name | Field Description | Mandatory |

| Credit Note Item | Select Item Name for the credit note from the list. | Yes |

| Credit Note Series | Select credit note from the list, already created in the application | Yes |

| Credit Date | Select credit note generated date from the calendar | Yes |

| Order Series | Select order series from the list, already created in the application | Yes |

| Is Tax Inclusive: | User can tick the check box, the tax is included for the credit note. | No |

| Point Value | Enter value points for the campaign to generate a credit note | Yes |

Finally, click on “Save.”