Introduction

Statutory components refer to the legally mandated elements of employee compensation, such as taxes, social security contributions, and other government-related deductions.

The BizGaze’s ‘Statutory Components app’ assists organizations in managing and calculating various statutory deductions and contributions required for payroll processing. It automates the complex calculations and ensures accurate compliance with legal requirements, reducing errors and saving time for HR and payroll departments. This app typically integrates with payroll systems to streamline the process and ensure that employees’ earnings align with legal standards.

Portlets & Widgets

In the layout view, a Portlet accurately represents each functionality, and its corresponding data is precisely viewed as a Widget. The following section includes the default portlets and widgets of the Statutory Components App.

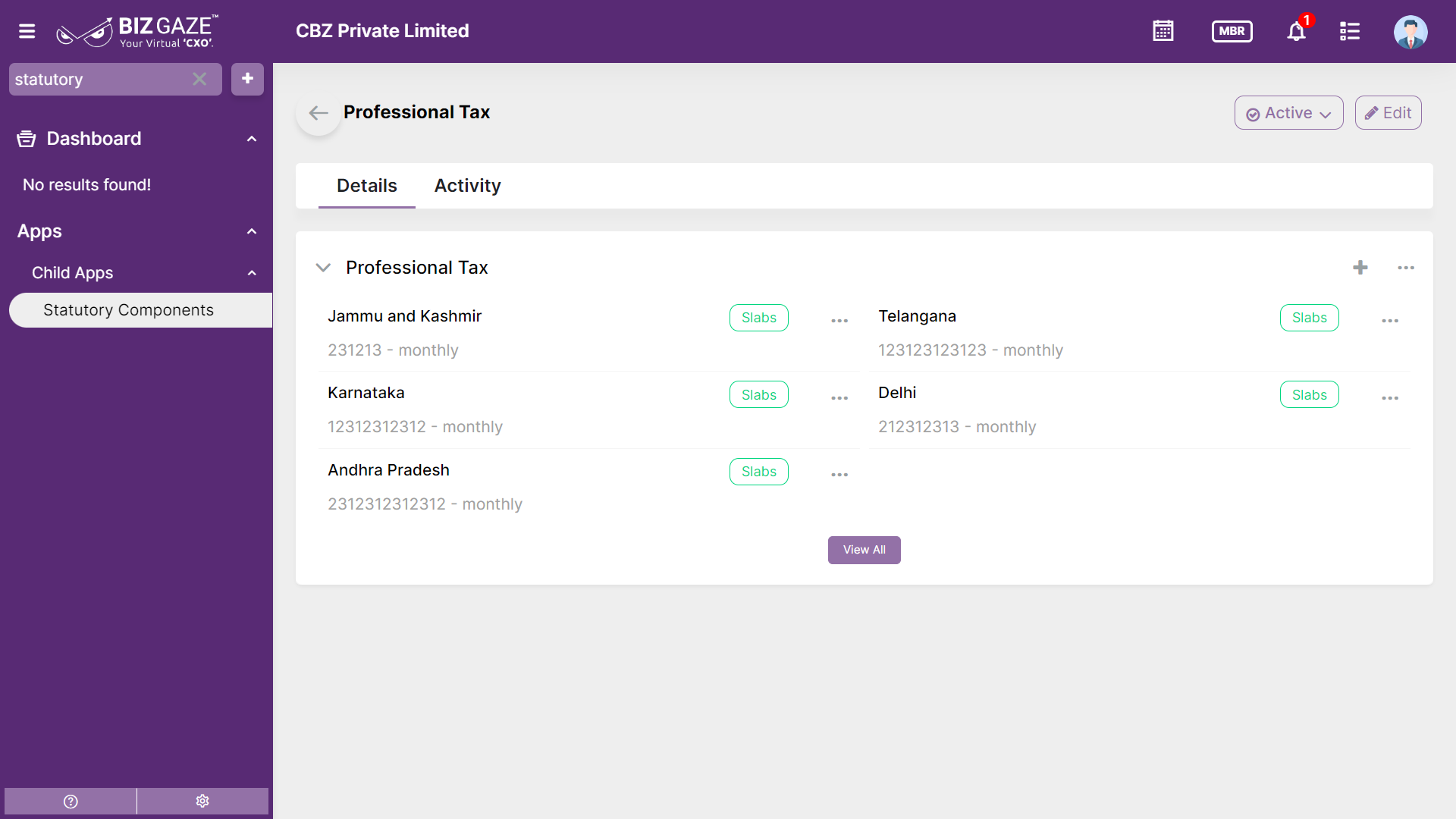

Professional Tax

This widget contains basic information about the Professional Tax

| Field name | Description |

| Location Name | Displays the name of the employees’ work location. It is the specific geographical area or jurisdiction for which professional tax regulations and calculations apply. It is usually a city, town, or region within a country |

| PT Number | A unique identification number assigned to an individual or entity by the tax authorities for tracking and managing their professional tax liabilities and payments is known as PT number or Professional Tax number |

| Deduction Cycle Name | It is the designated period during which professional tax deductions are made from an employee’s salary. It could be monthly, quarterly, or any other defined interval in accordance with local regulations. |

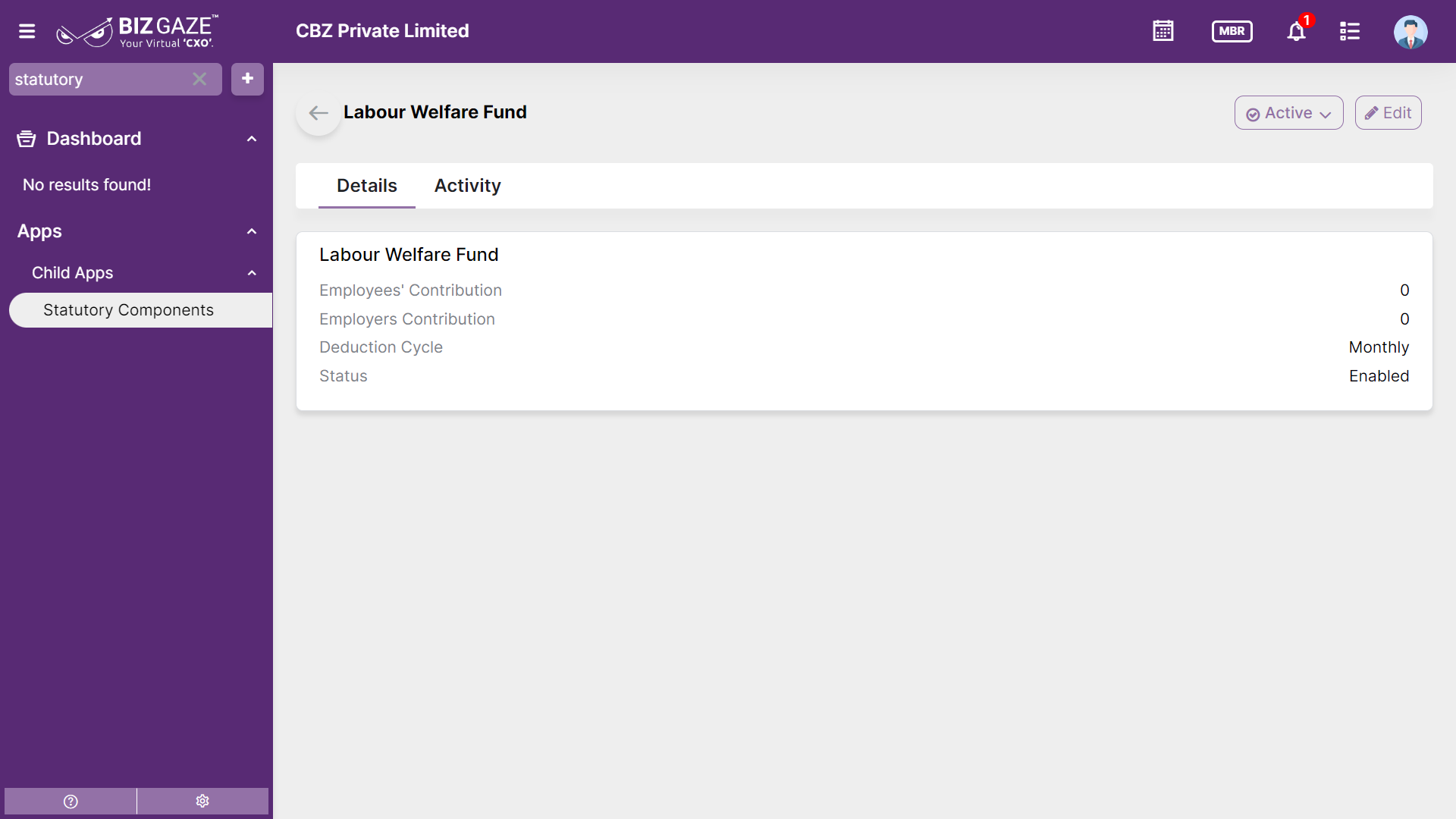

Labor Welfare Fund

This widget contains basic information about the Labor Welfare Fund

| Field name | Description |

| Employees’ Contribution | Displays the amount of employees’ contribution. It is the portion of funds contributed by employees from their wages to a designated labor welfare fund, aimed at promoting the well-being and welfare of workers |

| Employers Contribution | Displays the amount of employer’s contribution. The portion of funds contributed by employers to the labor welfare fund, which is separate from the employees’ contributions |

| Deduction Cycle | The specific time frame or frequency at which deductions are made from employees’ wages for their contributions to the labor welfare fund |

| Status | Displays the current status of the LWF (Labor Welfare Fund), whether it is enabled or not |

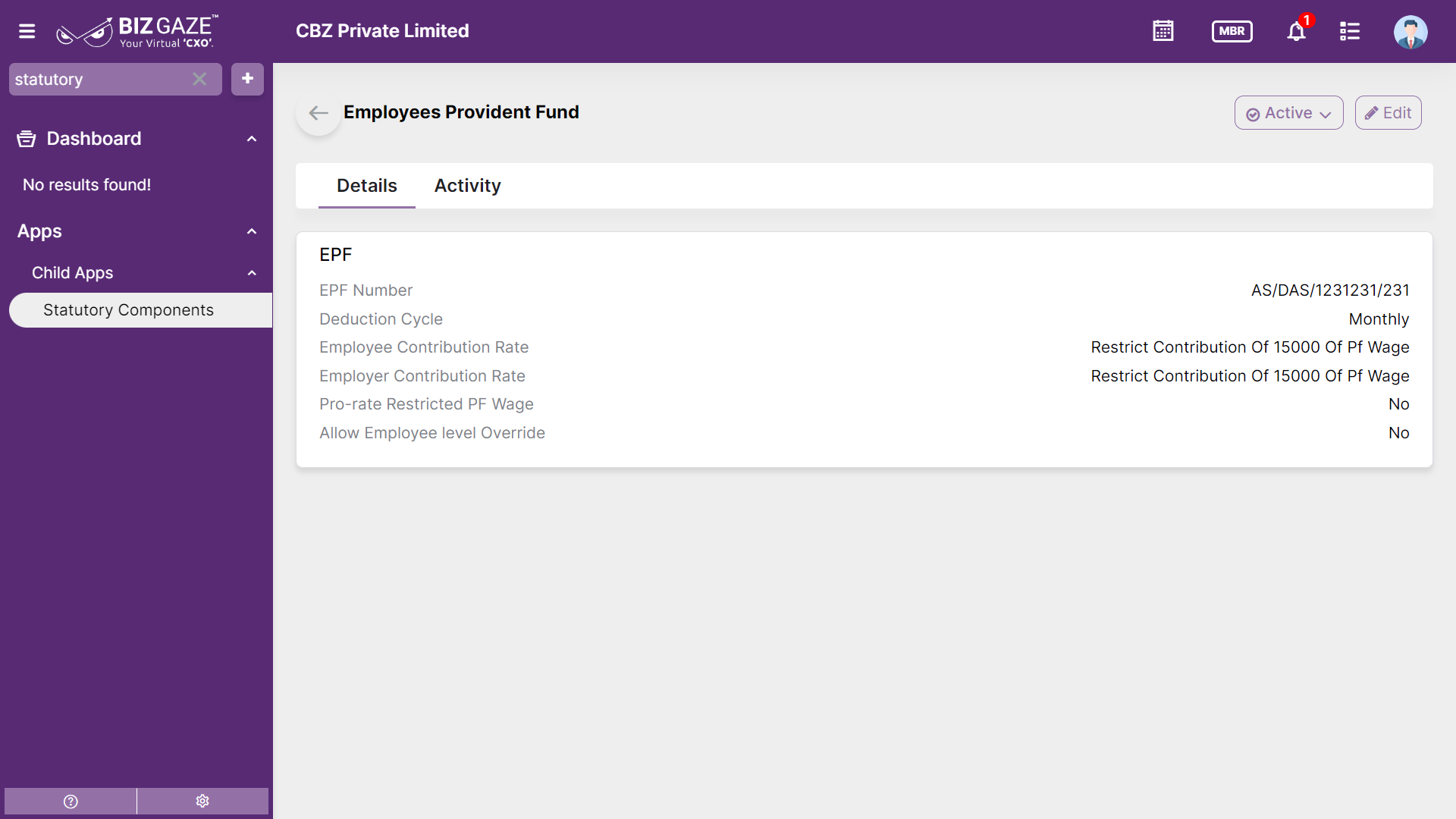

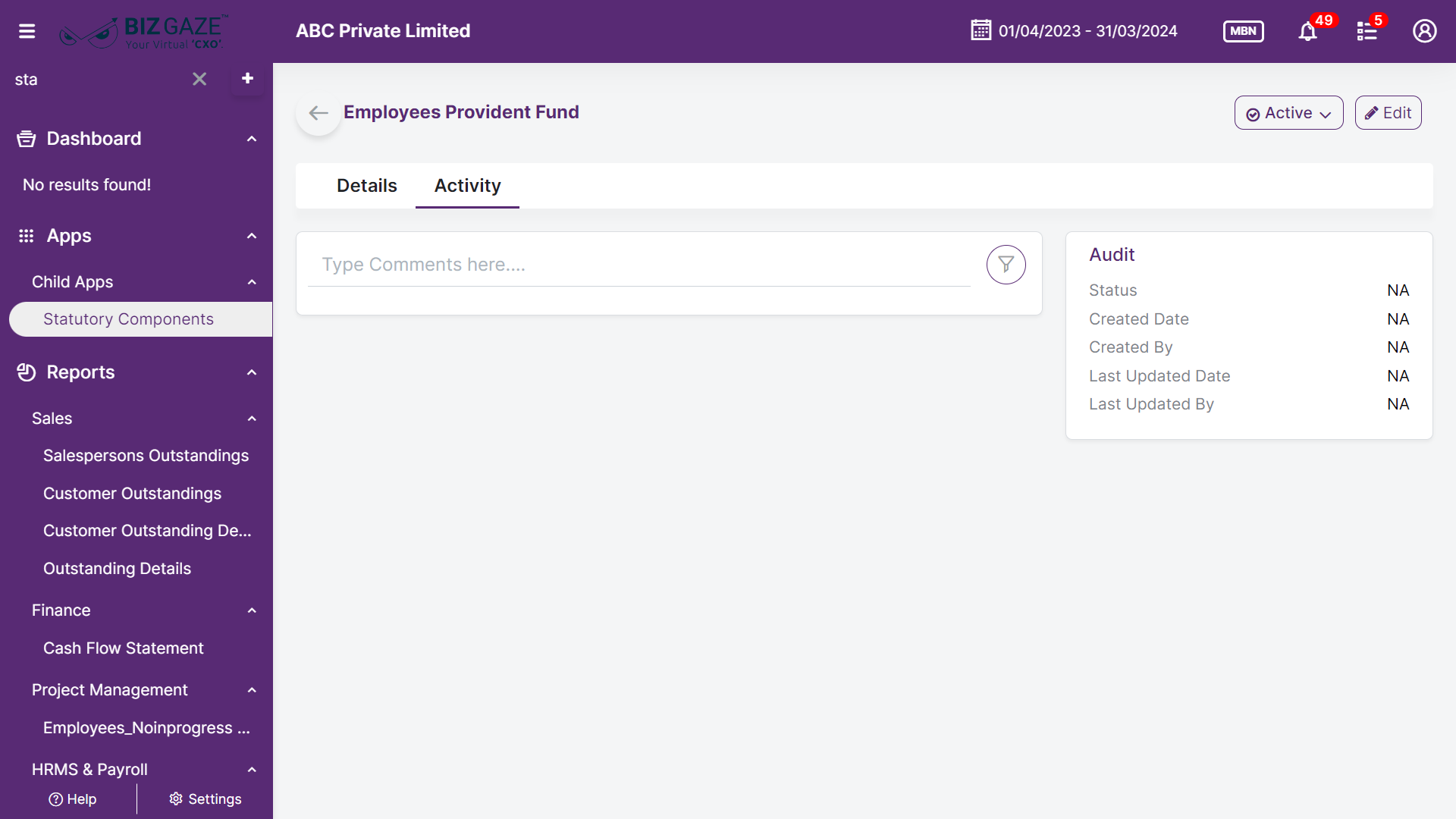

Employees Provident Fund

This widget contains basic information about the Employees Welfare Fund

| Field name | Description |

| EPF Number | An Employees’ Provident Fund (EPF) Number is a unique identification number assigned to each employee who contributes to the EPF scheme, allowing them to track and manage their provident fund contributions and benefits. |

| Deduction Cycle | The specific period, typically a month, during which contributions to the Employees’ Provident Fund (EPF) are calculated, deducted from employees’ salaries, and transferred to the EPF account. |

| Employee Contribution Rate | The percentage of an employee’s salary that they are required to contribute to their EPF account as part of their provident fund savings. |

| Employer Contribution Rate | The percentage of an employee’s salary that the employer is obligated to contribute to the employee’s EPF account, in addition to the employee’s contribution. |

| Pro-rate Restricted PF Wage | Displays whether Pro-rate Restricted PF Wage calculation is enabled or not. Pro-rate Restricted PF Wage calculation is the calculated portion of an employee’s salary, subject to a specific ceiling or limit, which forms the basis for calculating EPF contributions. |

| Allow Employee level Override | Displays whether Employee level Override is enabled or not. This term refers to a feature that allows individual employees to modify or override certain EPF-related parameters or calculations, based on their specific circumstances or preferences, while adhering to legal and organizational guidelines |

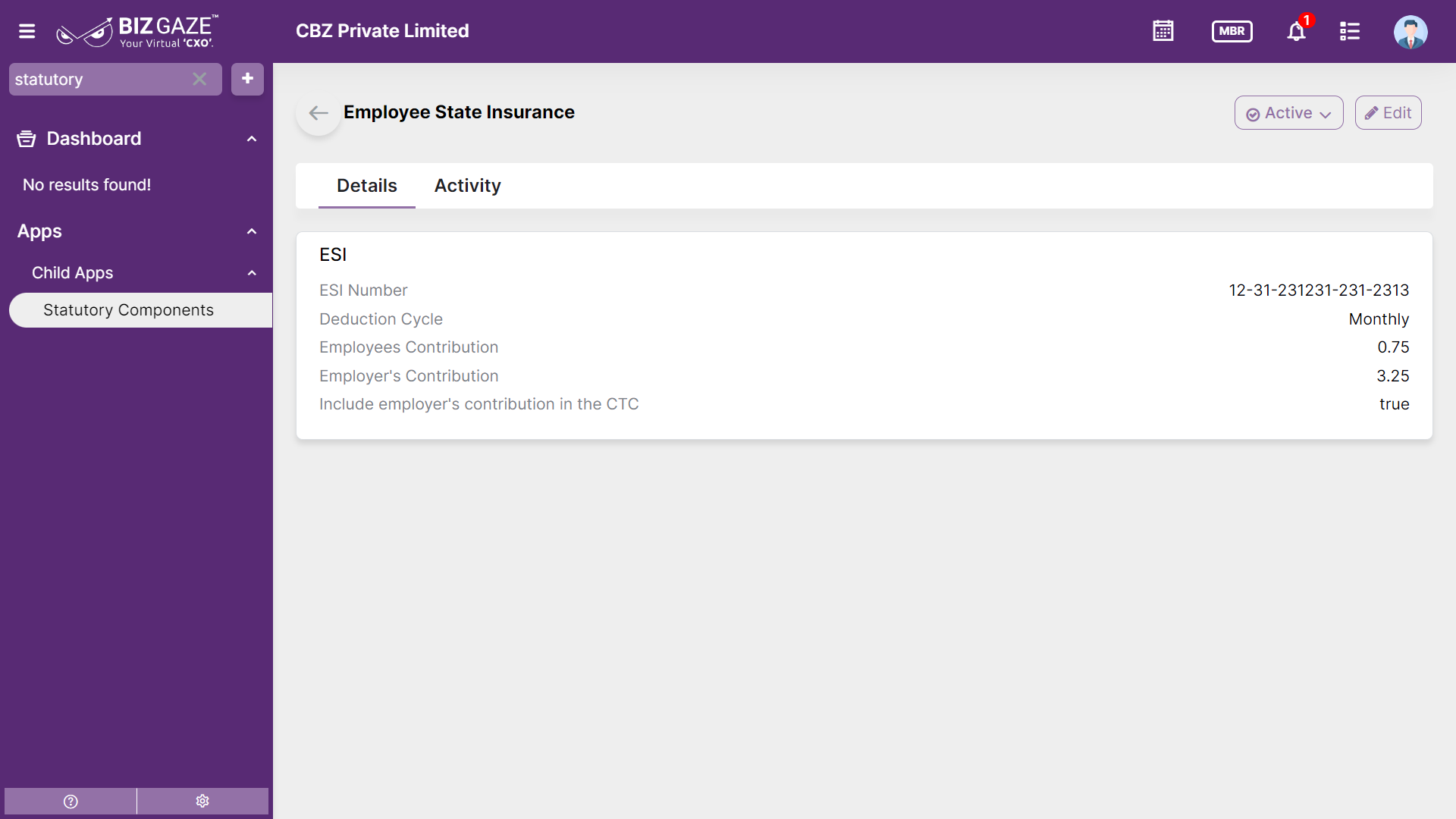

Employee State Insurance

This widget contains basic information about the Employees State Insurance

| Field name | Description |

| ESI Number | Displays ESI number of the employee. An ESI (Employee State Insurance) Number is a unique identification number assigned to eligible employees covered under the Employee State Insurance Act. It serves as a reference for availing medical and other benefits provided by the ESI scheme |

| Deduction Cycle | Displays the specific time period during which ESI contributions are collected and paid. In the context of ESI, contributions are usually deducted from employees’ wages on a monthly basis |

| Employees’ Contribution | The portion of the ESI contribution that is deducted from an employee’s salary. It is a fixed percentage of the employee’s gross salary and is contributed towards the ESI fund to avail medical and related benefits. |

| Employers Contribution | The part of the ESI contribution that the employer is required to pay on behalf of their employees. It is a certain percentage of the employees’ wages and is contributed to the ESI fund to cover medical expenses and benefits. |

| Include employer’s contribution in the CTC | Displays whether to Include employer’s contribution in the CTC setting is enabled or not. Including employer’s contribution in the Cost to Company (CTC) means that while presenting an employee’s compensation package, the monetary value of the employer’s contribution to ESI (and other benefits) is factored into the total package, even though it’s not directly received by the employee as cash |

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Field name | Description |

| Comments | User can write short notes or comments about the Statutory component |

| Audit | |

| Created Date | Date when the Statutory component is created |

| Created By | Name of the person who created the Statutory component |

| Last Updated Date | Last stage changed of the Statutory component |

| Last Updated By | Name of the person who last updated the stage |

| Status | Displays the current status of the Statutory component |

| Time-Line | This widget tracks all the activities within the app. |