Introduction

An integrator in measurement and control applications is an element whose output signal is the time integral of its input signal.

Stage Work Flow

The default stages of GST Integrator app are as follows:

| Stage Name | Stage Description |

| Partial | The integration was generated and doing changes. |

| Saved | The integration was completed with all the changes. |

| Submit | Submitted to GST portal. |

Portlets & Widgets

A layout view defined by the individual functionalities are called portlets and each functional data is designed and viewed as widgets. The default portlets and widgets are as follows:

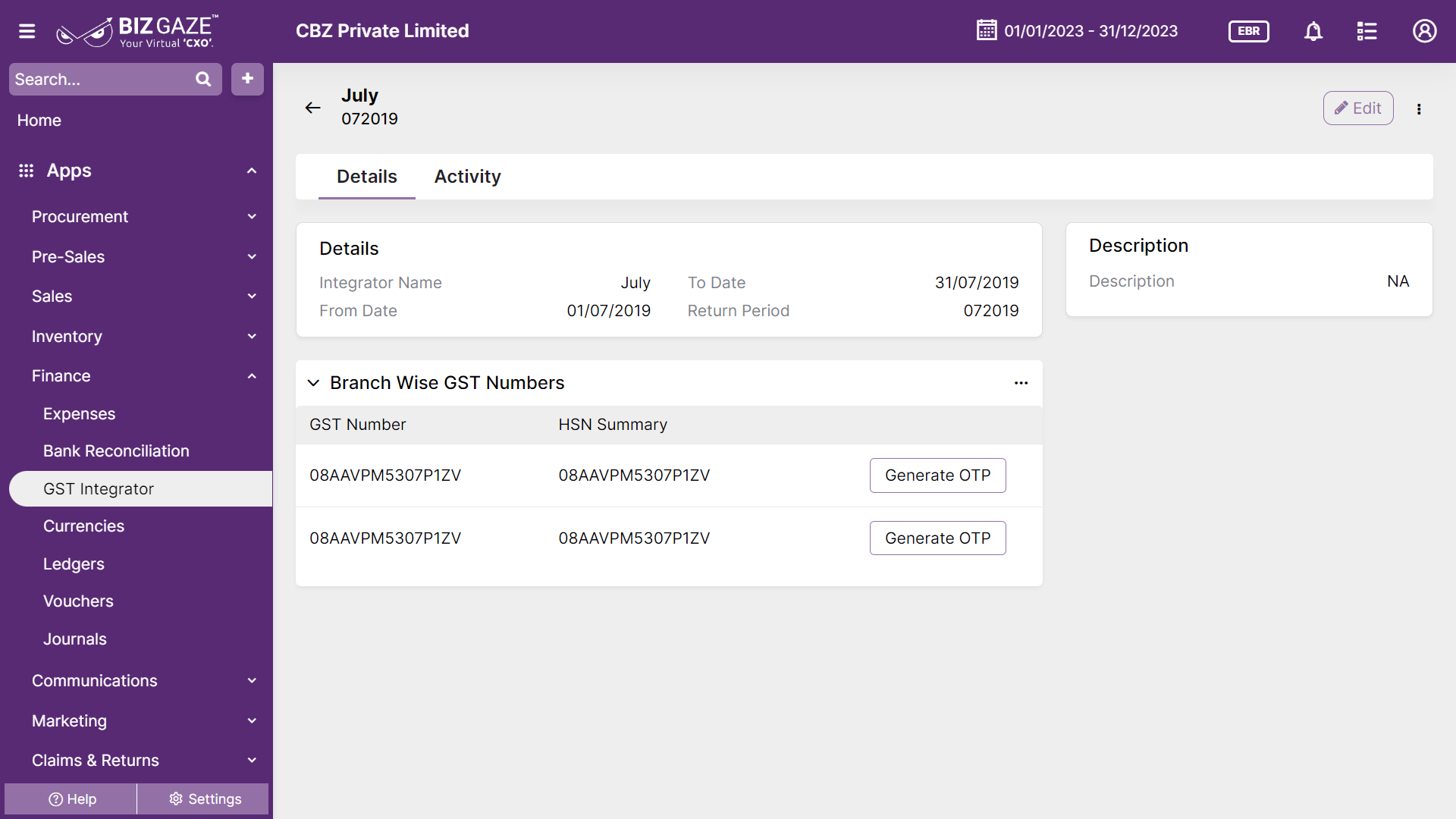

Details

This section contains Integrator name, return period, From and To date of the ledgers and integrator details

| Field name | Description |

| Integrator name | Displays name of the Integrator of an organization |

| Return period | Displays month and year of the GST return period |

| From date | Starting date of the ledger is displayed |

| To date | Closing date of the ledger is displayed |

Branch Wise GST numbers

This section contains Branch wise GST numbers of all the Invoices of various business types. User can also modify and Save the Invoices by clicking on “Save and Modify” option of particular Business type.

| Name | Branch Wise GST numbers | Invoices |

| B2B | Displays B2B ledger account’s GST number. In a B2B transactions the customer is also a registered person and is eligible to take Input Tax Credit. Invoice wise details of both Intra-state and inter-state supplies should be uploaded in GST return | Click on Save & Modify to save the Invoices |

| B2CL | Displays B2CL Ledger account GST number. B2CL (Business-to-Consumer) invoices related to taxable outward inter-State transactions between a Registered Supplier and an Unregistered Recipient, where the invoice value is a large amount | Click on Save & Modify to save the Invoices |

| B2CS | Displays B2CS Ledger account GST number. B2CS (Business to Consumers Small) invoices refer to invoices that are issued to consumers with its total value less than 2.5 lakh. | Click on Save & Modify to save the Invoices |

| NIL | Displays Nil rated ledger account’s GST number. NIL rated or Zero rating is meant that the entire value chain of the supply is exempt from tax. | Click on Save & Modify to save the Invoices |

| HSN | Displays HSN code of the invoice. HSN stands for Harmonized System of Nomenclature and is used to classify goods in a systematic manner | Click on Save & Modify to save the Invoices |

| Sales Return | GST number of the sales return on the credit note issued is displayed. When the goods are returned by a registered recipient, then the seller will issue a credit note to the buyer. | Click on Save & Modify to save the Invoices |

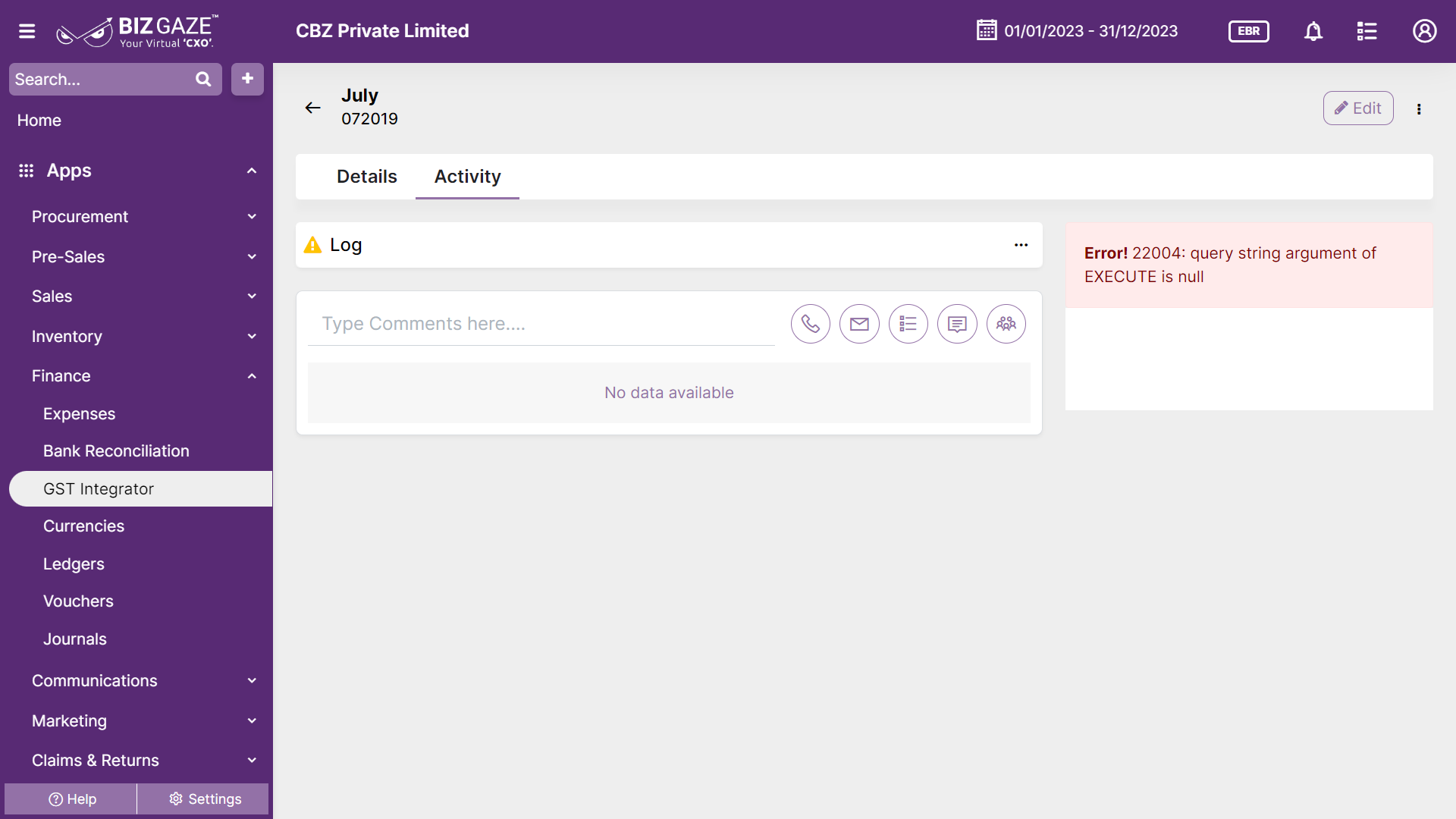

| Log | An activity log is a recorded log of how time is spent or log entries. Within organizations, activity logs are typically used to track how employees or customers are spending their time. |

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Field name | Description |

| Comments | User can write short notes or comments about the GST Integrator |

| Audit | |

| Created Date | Date when the GST Integrator is created |

| Created By | Name of the person who created the GST Integrator |

| Last updated date | Last stage changed of the GST Integrator |

| Last Updated By | Name of the person who last updated the stage |

| Status | Displays the current status of the GST Integrator |

| Time-Line | This widget tracks all the activities within the app. |

Reports

A report is a document that presents information in an organized format for a specific audience and purpose. Although summaries of reports may be delivered orally, complete reports are almost always in the form of written documents

- GST Integrator Master