Introduction

When a customer wants to return a product and expects to receive the full amount paid for the product, the user can create a sales return or else can generate a credit note and update the wallet of the customer. Sale return can be created only on the confirmed stage sales invoices.

Stage Workflow:

Default stages and workflow for Sales Return App:

| Stage Name |

Stage Description |

| Draft | The return invoice is created but not yet confirmed |

| Active | The invoice is created with a temporary number |

| Confirmed | The invoice is successfully generated |

| Partial Paid | The invoice with partial payment |

| Paid | The invoice with complete payment |

| Void | The invoice is invalid or nullified |

Default Portlets(Tabs) & Widgets:

In the layout view, a Portlet accurately represents each functionality, and its corresponding data is precisely viewed as a Widget. The following section includes the default portlets and widgets of the Sales Return App.

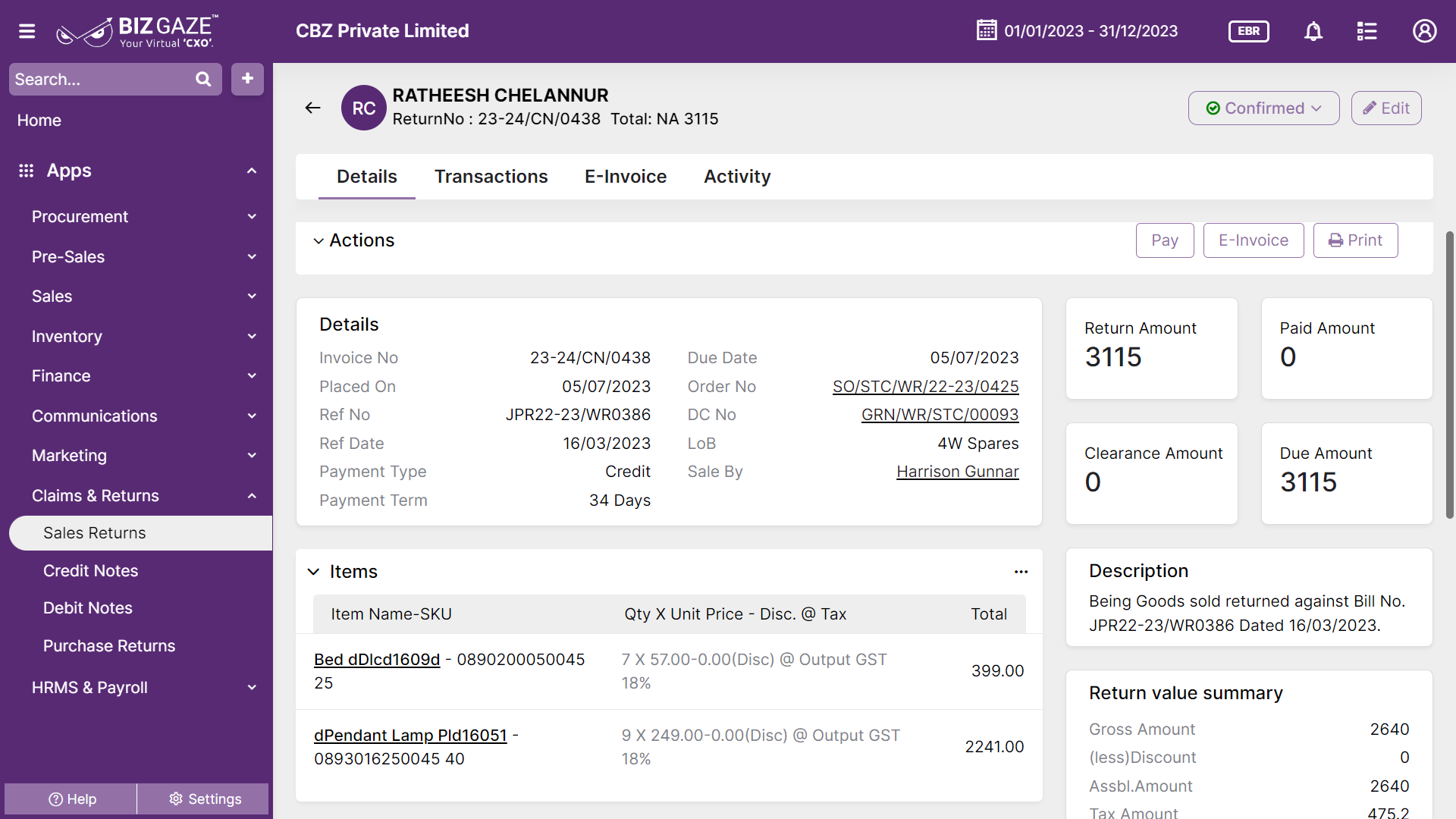

This section contains about the Invoice information

| Field name | Description |

| Return no. | A return number in Sales refers to a unique identifier that is assigned to a product that has been returned by a customer. It facilitates tracking and management of billing-related activities for both the buyer and the seller |

| Placed on | It refers to the date the customer placed the return. It is important for tracking purposes and helps determine the expected returns timeline |

| Due date | It refers to the date by which a payment is required to be made to a creditor or supplier. It is the deadline for payment, and failure to make payment by this date may result in late fees, penalties, or other consequences. |

| Order no | A unique identifier assigned to the customer’s order, allowing both parties to track and manage the order throughout the fulfillment process. |

| Ref no | Displays the reference number of the invoice. Reference number is assigned for quick identification purpose |

| Ref date | Displays the reference date of the invoice that helps in quick identification |

| DC no | A unique identifier assigned to the delivery challan accompanying the shipment. This number helps to link the shipment to the corresponding order and invoice. |

| LoB | LoB refers to the specific industry segment or product category associated with the transaction. It is useful for managing and tracking sales data and inventory related to different product lines or divisions within a company. |

| Payment type | Displays payment mode of the transaction. Payment type refers to the method the customer makes payment for the goods or services received like cash, credit, debit, bank transfers, or digital wallets. |

| Payment term |

1.Payment term refers to Specific term of days or Period for which the Invoice due to be cleared. If the Payment Term Exceeds penalties/ Discount can be applied for Late & early Payments 2.User can select the payment term manually or will be loaded by default based on the Payment Term rules Configured |

| Sale by | Displays sales person name. It refers to the seller or the company providing the goods or services to the buyer. |

Items

Item section contains details about the items that are returned, which means that the item was returned back to the person who has shipped the product.

| Field name | Description |

| Item name | Item name refers to the name or title of a product, service, or item that is being offered for sale or purchase. It is typically used to describe the product or item in a concise and clear manner, so that customers can easily understand what it is and what it does. |

| SKU | Displays SKU code of the item. A SKU, which stands for Stock Keeping Unit, is a unique identifier for each of the products that makes it easier to track inventory |

| Quantity | Quantity refers to the numerical value that represents the number of items, products, or units that are being purchased or sold in a transaction. It is the total number of units of a product or service that a customer is ordering or a seller is providing. |

| Field name | Description |

| Invoiced Amount | Invoiced Amount should be renamed to Return Invoice Amount & Displays the Total amount of the Return invoice. It refers to the total amount that is credited or refunded to a customer when they return goods or merchandise to a supplier or vendor. This amount includes the original purchase price of the goods, any applicable taxes, and any shipping or handling fees that were charged at the time of purchase. |

| Paid Amount | It refers to the payment amount paid for the Invoice. |

| Clearance Amt | The amount for which the receipts were created but not yet confirmed. |

| Due Amount | It can refer to an outstanding balance of Customer as well as an unpaid invoice or bill for goods or services rendered. |

| Pay: User can click on Pay option which directs to Payments module for making payment |

Invoice Value summary

An invoice value summary provides a comprehensive overview of the total cost of a customer’s order, including all the items purchased, their individual costs, and any additional charges such as taxes, discounts, and shipping fees.

| Field name | Description |

| Gross Amount | Gross Amount refers to the total amount of money or value of a transaction before any deductions or expenses are taken into account. It includes all charges, fees, taxes, and other costs associated with the transaction. |

| Discount | Total discount value given on the item. The “Discount on Items” value is loaded automatically. |

| Total Tax amount | Total Tax Amount refers to the sum of all taxes that are applicable to a transaction or purchase. |

| Assebl. amount | Assessable Amount refers to the before tax and after discount amount. |

| TCS amount | TCS amount applied is displayed. Tax Collected at Source (TCS) is a tax payable by a seller which he collects from the buyer at the time of sale of goods. |

| Adjustment | Adjustment amounts made from the wallets |

| Net Total | Net Total refers to the final amount that remains after all deductions, discounts, taxes, and other charges have been subtracted from the Gross Amount. It is the actual amount that a customer is required to pay for a product |

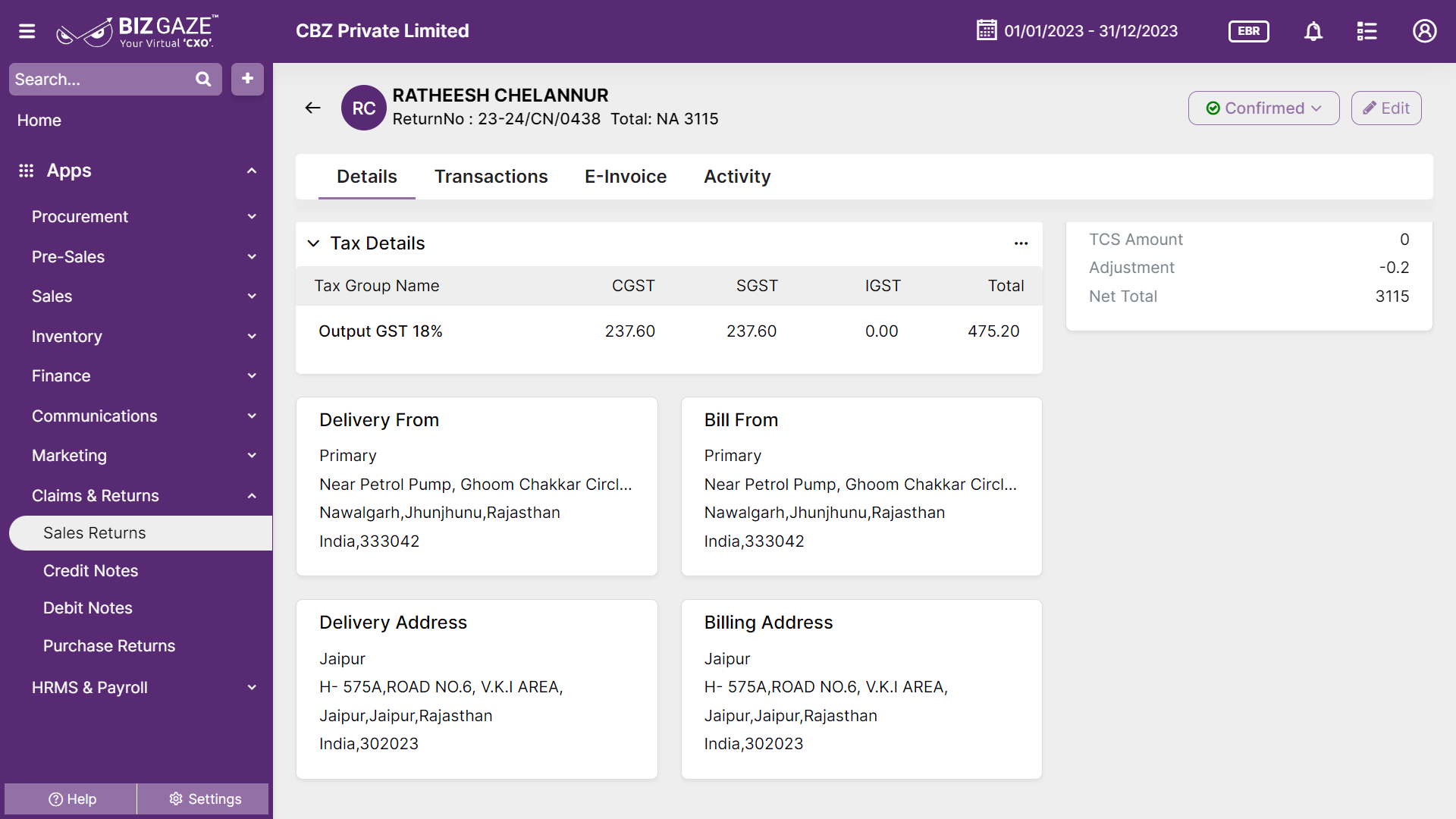

Tax details

Tax details refer to the information related to taxes that are applied to a transaction, such as the sale of goods or services. Tax details are usually included in invoices or other financial documents to ensure proper calculation, reporting, and payment of taxes as required by law.

This section contains the Tax amount(s) applied on the Invoice.

| Field name | Description |

| Tax Group name | Tax group name is displayed. A tax group facilitates collecting more than one set of taxes under a single set of rules. |

| CGST | Displays CGST (Central Goods and Services Tax) tax amount on the invoice. The GST to be levied by the Centre on Intra state supply of goods and / or services is Central GST (CGST) |

| SGST | Tax amount of SGST (State Goods and Services Tax) in the invoice. The GST to be levied by the State on Intra state supply of goods and / or services is State GST (SGST) |

| IGST | IGST (Integrated Goods and Services Tax) tax amount added in the invoice is displayed. On supply of goods and services outside the state, Integrated GST (IGST) will be collected by Centre. |

Billing and shipping address

| Field name | Description |

| Delivery Address | Delivery Address refers to the physical location where a package or item is intended to be delivered. It typically includes the recipient’s name, street address, apartment or unit number (if applicable), city, state or province, zip or postal code, and country |

| Delivery from | Delivery From refers to the physical location where a package or item is being shipped or dispatched from. It is the origin or starting point of the delivery process, from where the package or item is sent to the delivery address. |

| Bill From | Sold By refers to the entity or business that is offering a product or service for sale. It could be the manufacturer, distributor, retailer, or a third-party seller. |

| Billing address | Billing Address refers to the address where a customer receives their billing statements or invoices for goods or services they have purchased. |

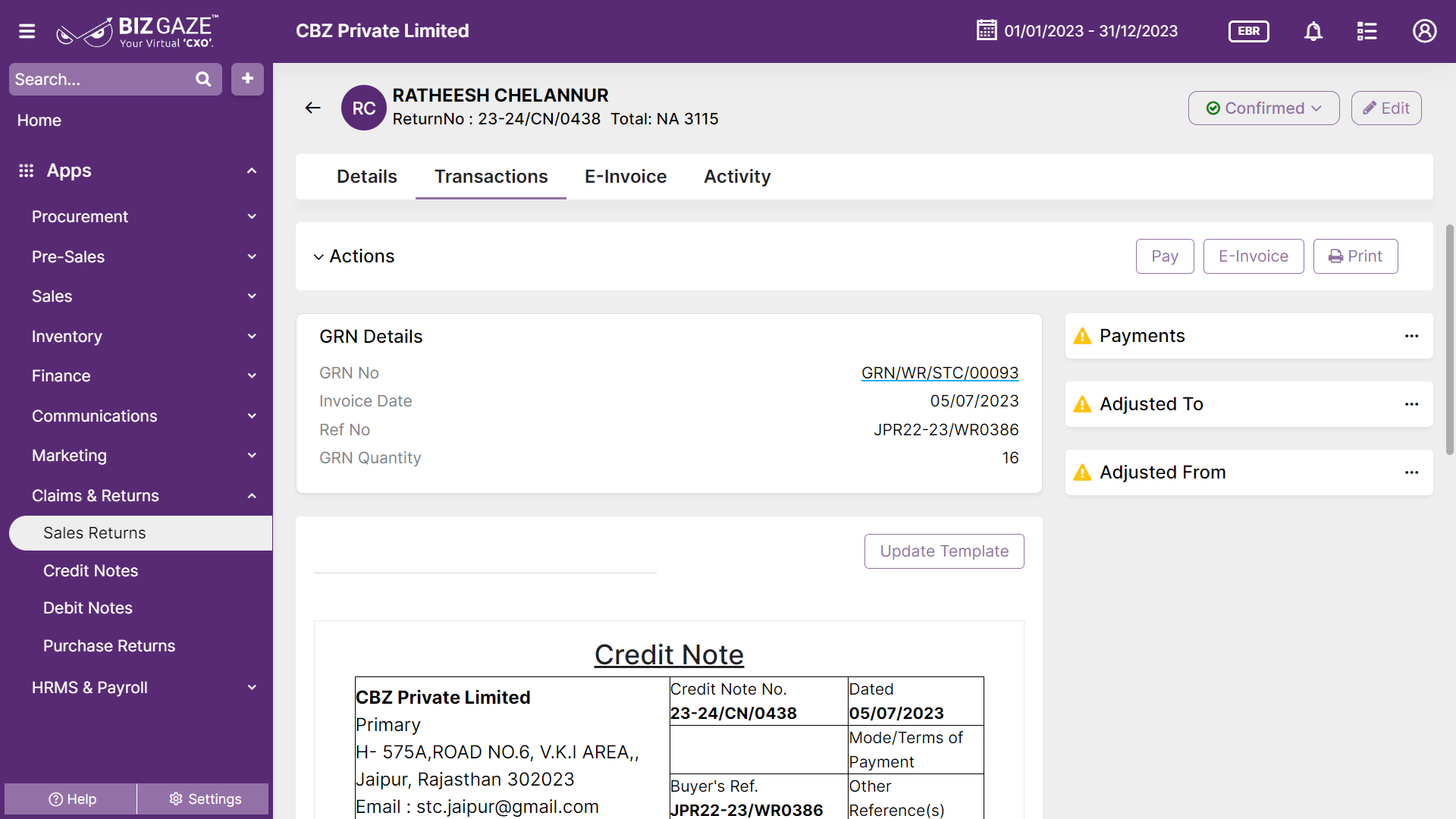

This section contains transaction details of the customer. A transaction is an event or action that involves the exchange of goods, services, or financial assets between two or more parties.

GRN Details

This section contains details about the GRN created for the order placed. Goods received note is a document that acknowledges the delivery of goods to a customer by a supplier

| Field name | Description |

| DC no | Delivery Challan number of the order is displayed. It is a unique identifier assigned to the Delivery Challan for tracking purposes. |

| Ref no | Reference number of the return order |

| Invoice date | Date on which the invoice is created for the order |

| GRN Quantity | Quantity of order items for which GRN is created. It is the total number of units of the order items for which GRN is created. |

Connect DC

| Field name | Description |

| Connect DC |

1. User can able to make Connect other GRN’s irrespective of the GRN created for the Invoice. 2. GRN can be disconnected to make any changes/cancel the Invoice or create a new invoice in some special cases. |

Payments

A payment is the transfer of money or value from one party to another to fulfill a financial obligation or settle a transaction. This section contains payment details of the invoice.

| Field name | Description |

| Payment mode | Displays payment method used for the transaction. Payment types refer to the various methods by which customers can pay for goods and services. |

| Ref no. | Reference number of the payment. A reference number of the order helps to track and identify easily |

| Invoice amount | The invoice amount is the actual price that the end-customer retailer pays to the manufacturer or distributor for a product |

| Field name | Description |

| Adjusted From | Adjusted from shows the data of entries adjusted from wallets/ Journals in payments. |

| Adjusted To | Adjusted To shows the Invoices data to which the wallet amount is adjusted. |

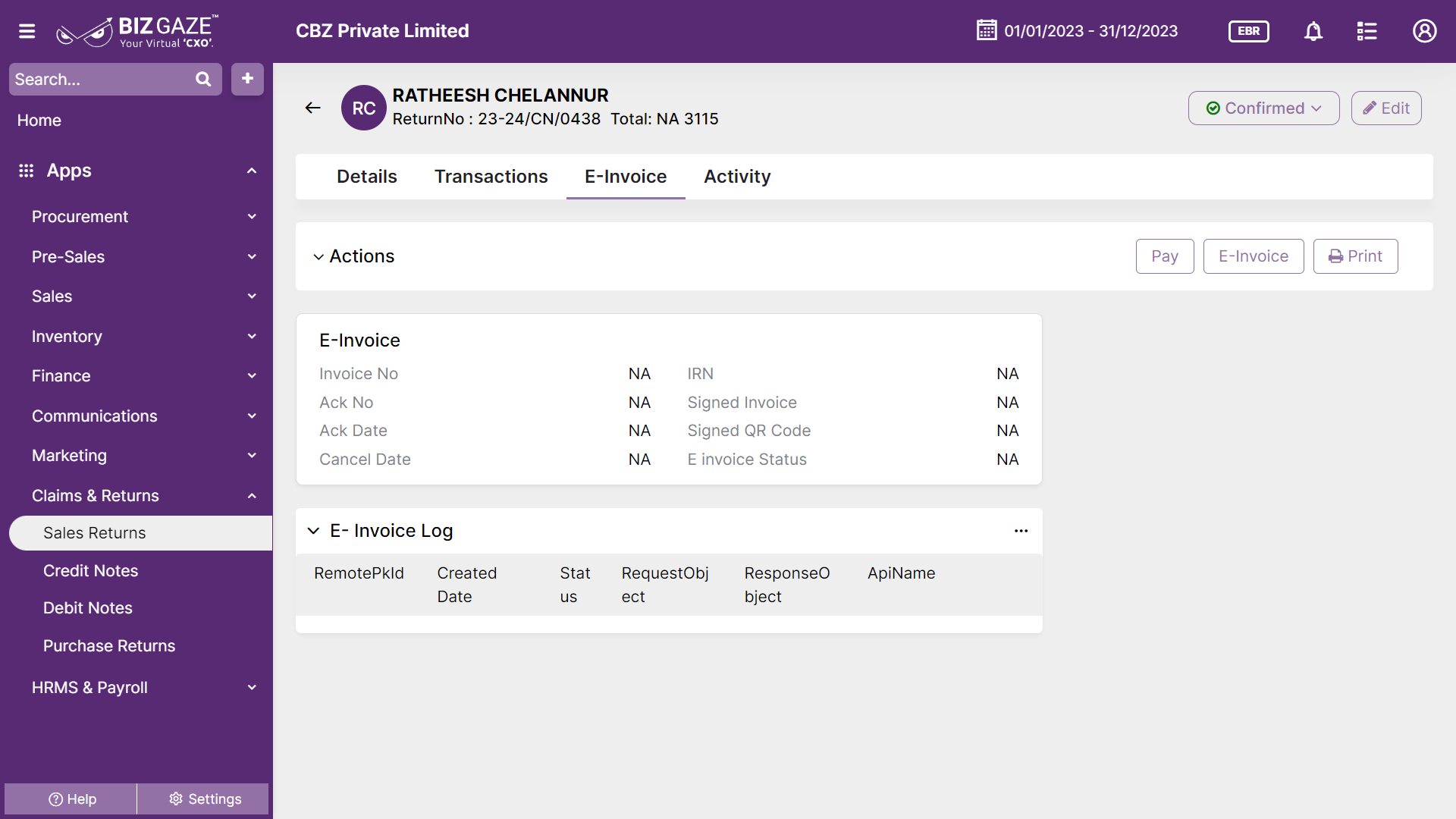

An E-invoice is an electronically delivered invoice in a specified standardized format. E-invoices contain invoice data in a structured form and can be automatically imported into the buying organization’s accounts payable system.

| Field name | Description |

| Invoice no. | The invoice number of the order is displayed. It refers to unique identifier that is assigned to an invoice in order to track and manage payment transactions. The invoice number is typically a series of numbers or alphanumeric characters that are assigned sequentially or randomly to each invoice generated by system or Manually assigned. |

| IRN (Invoice Reference Number) | Displays the Invoice Reference Number (IRN). It is a unique number generated by the Invoice Registration Portal (IRP) using a hash generation algorithm, under the e-invoicing system. |

| Ack no. | Displays the acknowledgement number of the order. Acknowledgement number is a unique series of digits that is provided by the Indian government once the quarterly returns are filed |

| Ack Date | The acknowledgement date on the invoice |

| Signed Invoice | The signed invoice an invoice is generally considered a one-sided agreement until the client has signed it |

| Signed QR Code | A Signed QR code is a type of Quick Response (QR) code that has been digitally signed with a digital signature by a trusted entity such as a certificate authority. |

| Cancel date | The cancellation date of the order |

| E-Invoice Status | The current status of the E-invoice is displayed |

| GST Invoice type details | This section contains GST invoice type details. The invoice is an important document that provides details of the transaction and helps in claiming input tax credit. |

| e-Invoice Log | |

| e-Invoice Log | This widget shows the log entries of the E-invoices created |

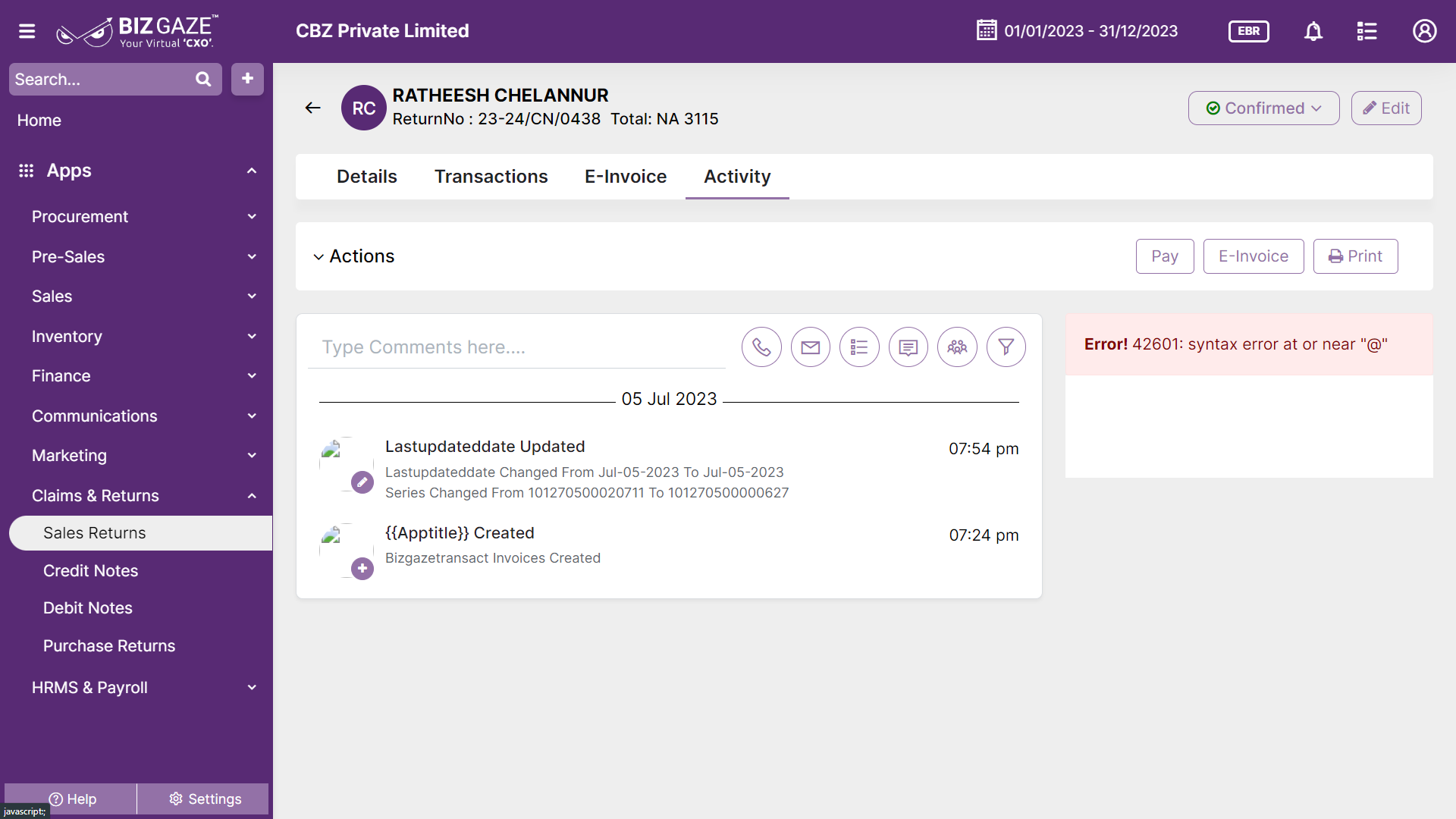

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Field name | Field Description |

| Comments | User can write short notes or comments about the Sales return |

| Audit | |

| Created Date | Date when the Sales return is created |

| Created By | Name of the person who created the Sales return |

| Last Updated Date | Last stage changed of the Sales return |

| Last Updated By | Name of the person who last updated the stage |

| Status | Displays the current status of the Sales return |

| Time-Line | This widget tracks all the activities within the app. |

Reports

A report is a document that presents information in an organized format for a specific audience and purpose. Although summaries of reports may be delivered orally, complete reports are almost always in the form of written documents.

- Sales Returns reports