Introduction

Tax slabs refer to the progressive tiers or categories into which taxable income or transactions are divided, each with its own applicable tax rates. Tax authorities often establish tax slabs to ensure a fair and graduated taxation system, where individuals or entities with higher incomes are subject to higher tax rates. A Tax Slabs app assists customers and organizations in understanding and managing their tax obligations based on the applicable tax slabs.

With BizGaze’s “Tax Slabs” app, customers and organizations can accurately calculate their tax liabilities, stay informed about tax regulations, optimize tax planning, and ensure compliance with tax laws.

Stage Workflow

| Stage Name | Description |

| Active | The tax slab is actively in use and applied to assess and calculate income tax liabilities for individuals or entities |

| Inactive | Temporarily not in use or suspended, often due to changes in tax laws |

| Deleted | It has been permanently removed or eliminated from the tax system |

Portlets & Widgets

In the layout view, a Portlet accurately represents each functionality, and its corresponding data is precisely viewed as a Widget. The following section includes the default portlets and widgets of the Tax Slabs App.

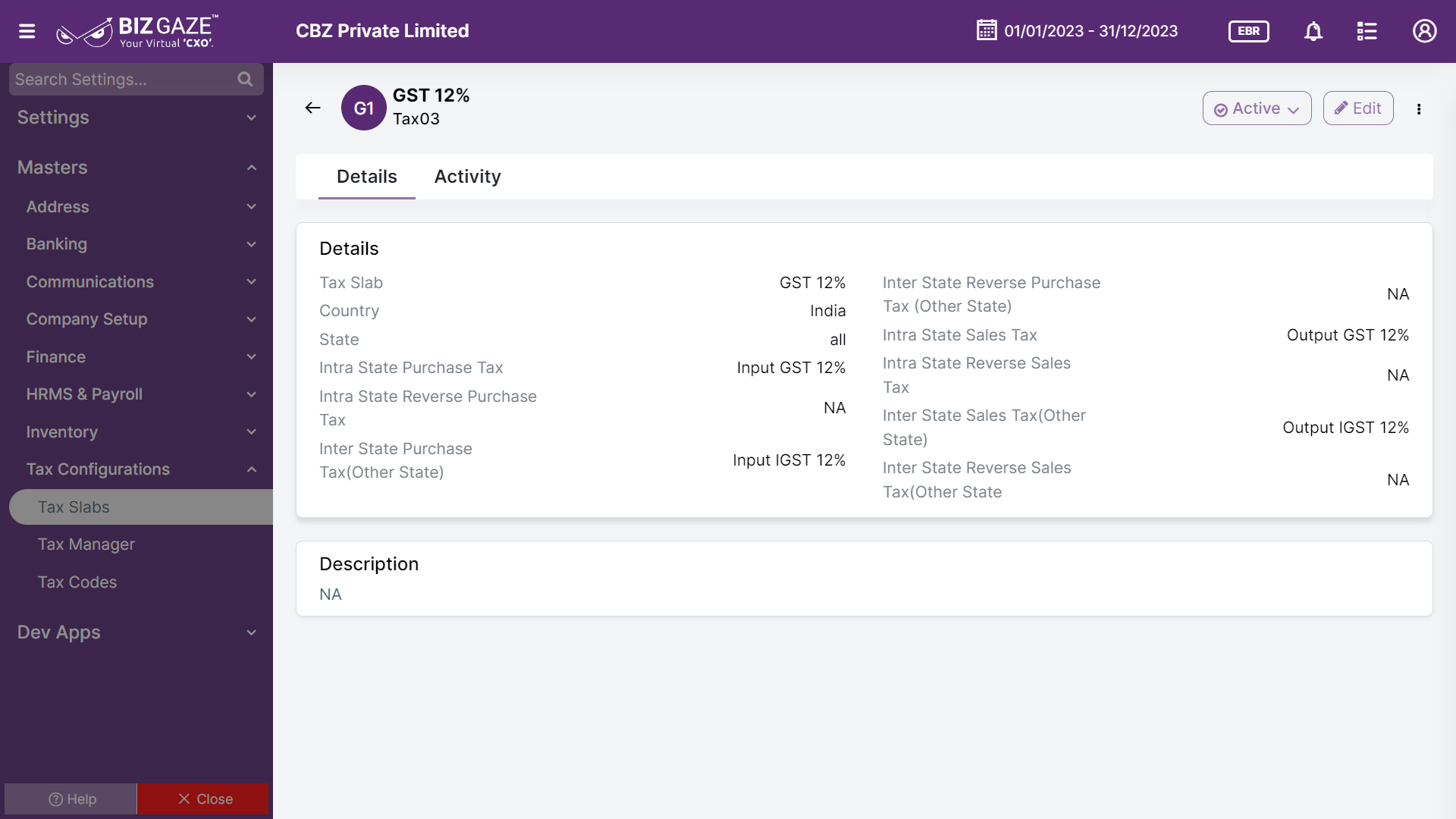

Details

This widget contains the tax slab details and its various taxes applied applied to determine the amount of income tax owed by specific individual

| Field name | Description |

| Tax Slab | The name of the tax slab is displayed. It is the specific identifier title or label given to a particular tax bracket or range within the tax system |

| Country | Displays name of the country. Here the country name refers to where the tax system is established and enforced |

| State name | State name is displayed. The state or province where the tax system is implemented. Different states within a country may have their own tax laws, tax rates, and tax slabs that can vary from one another |

| Intra State Purchase Tax | Displays the CGST/ SGST tax imposed on the purchase of goods or services within the same state. It is levied by the state government on Intra-state transactions |

| Intra State Reverse Purchase Tax | Displays the CGST/ SGST tax for the reverse purchase services within the same state, but the recipient of the goods or services is liable to pay Goods and Services Tax (GST) instead of the supplier. |

| Inter State Purchase Tax (Other state) | Displays the IGST tax applied for the services between two other states. It is the tax levied on the purchase of goods or services when the transaction occurs between two different states within the same country |

| Inter State Reverse Purchase Tax (Other state) | Displays IGST tax for the services between two other states. It refers to the tax liability that is reversed or shifted from the supplier to the buyer in an inter-state purchase |

| Intra State Sales Tax | Displays the CGST/SGST the tax imposed on the sale of goods or services within the same state |

| Intra State Reverse Sales Tax | Displays CGST/SGST the tax paid on the sale of goods or services within the same state, but the responsibility for paying the tax is transferred from the seller to the buyer |

| Inter State Sales Tax (Other state) | Displays the IGST tax imposed on the sale of goods or services when the transaction occurs between two different states within the same country |

| Inter State Reverse Sales Tax (Other state) | The IGST tax for the services between two other states. The reversal or transfer of the tax liability from the seller to the buyer in an inter-state sale. The buyer is responsible for paying the tax to the government of the state where the sale occurs. |

| Description | Comments or short notes about the Tax Slab are displayed |

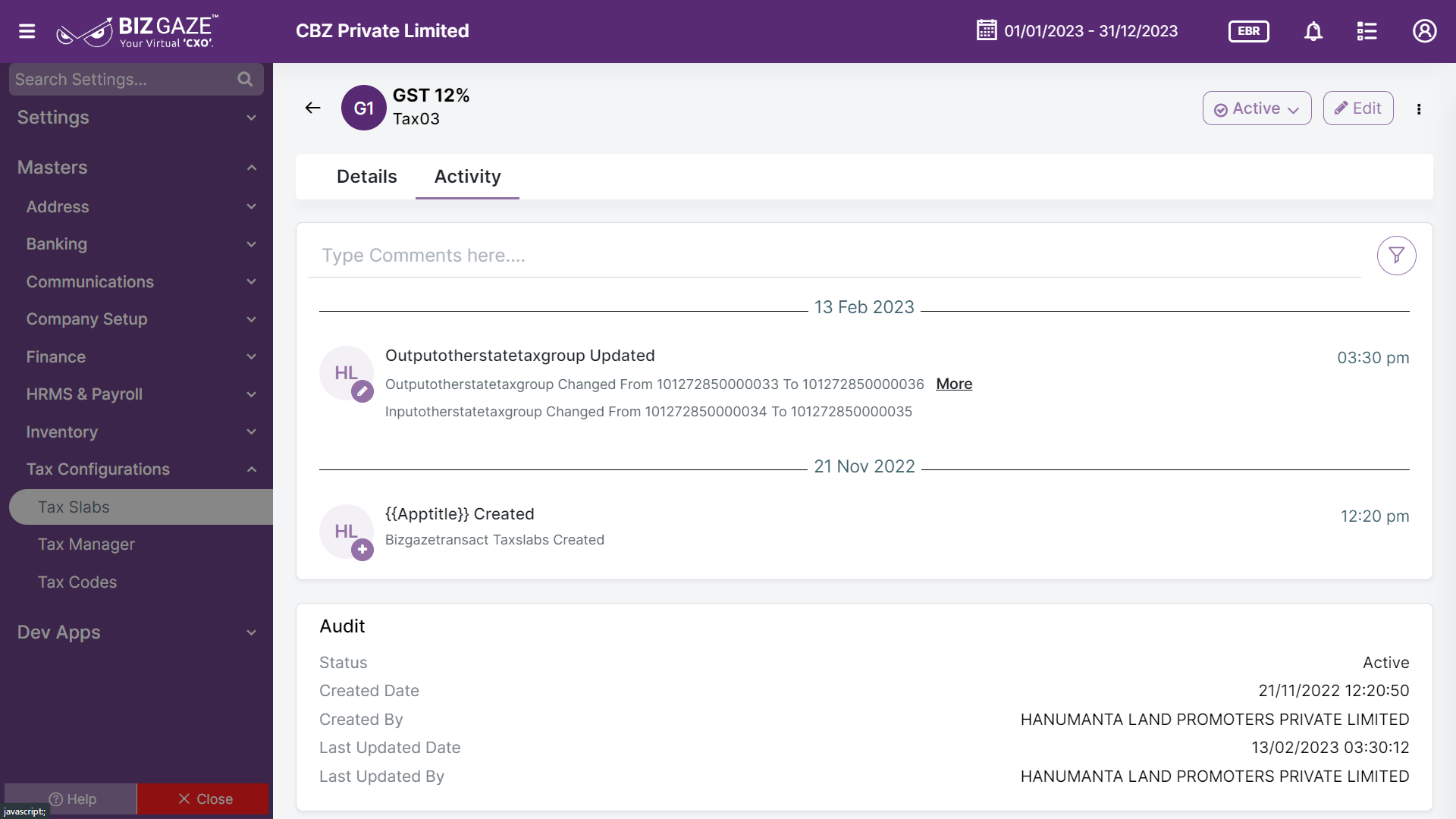

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Field Name | Field Description |

| Comments | User can write short notes or comments about the Tax Slab |

| Audit | |

| Created Date | Date when the Tax Slab is created |

| Created By | Name of the person who created the Tax Slab |

| Last updated date | Last stage changed of the Tax Slab |

| Last updated by | Name of the person who last updated the stage |

| Status | Displays the current status of the Tax Slab |

| Time-Line | This widget tracks all the activities within the app. |

Reports

A report is a document that presents information in an organized format for a specific audience and purpose. Although summaries of reports may be delivered orally, complete reports are almost always in the form of written documents.

- Tax Slabs Masters