Introduction

Every business follows standard taxes defined by the respective government. The tax definition varies depending on the transaction done by the vendor or customer, i.e., Input GST, Output GST.

“BizGaze” provides all tax configurations in a simple Tax manager app, where users can create a custom tax group for the required business verticals.

Stage Workflow

| Stage Name | Description |

| Active | Tax Manager is currently in use and operational |

| Inactive | Tax Manager is temporarily not in use or deactivated |

| Deleted | Tax Manager is permanently removed or eliminated from the system |

Portlets & Widgets

In the layout view, a Portlet accurately represents each functionality, and its corresponding data is precisely viewed as a Widget. The following section includes the default portlets and widgets of the Tax Manager App.

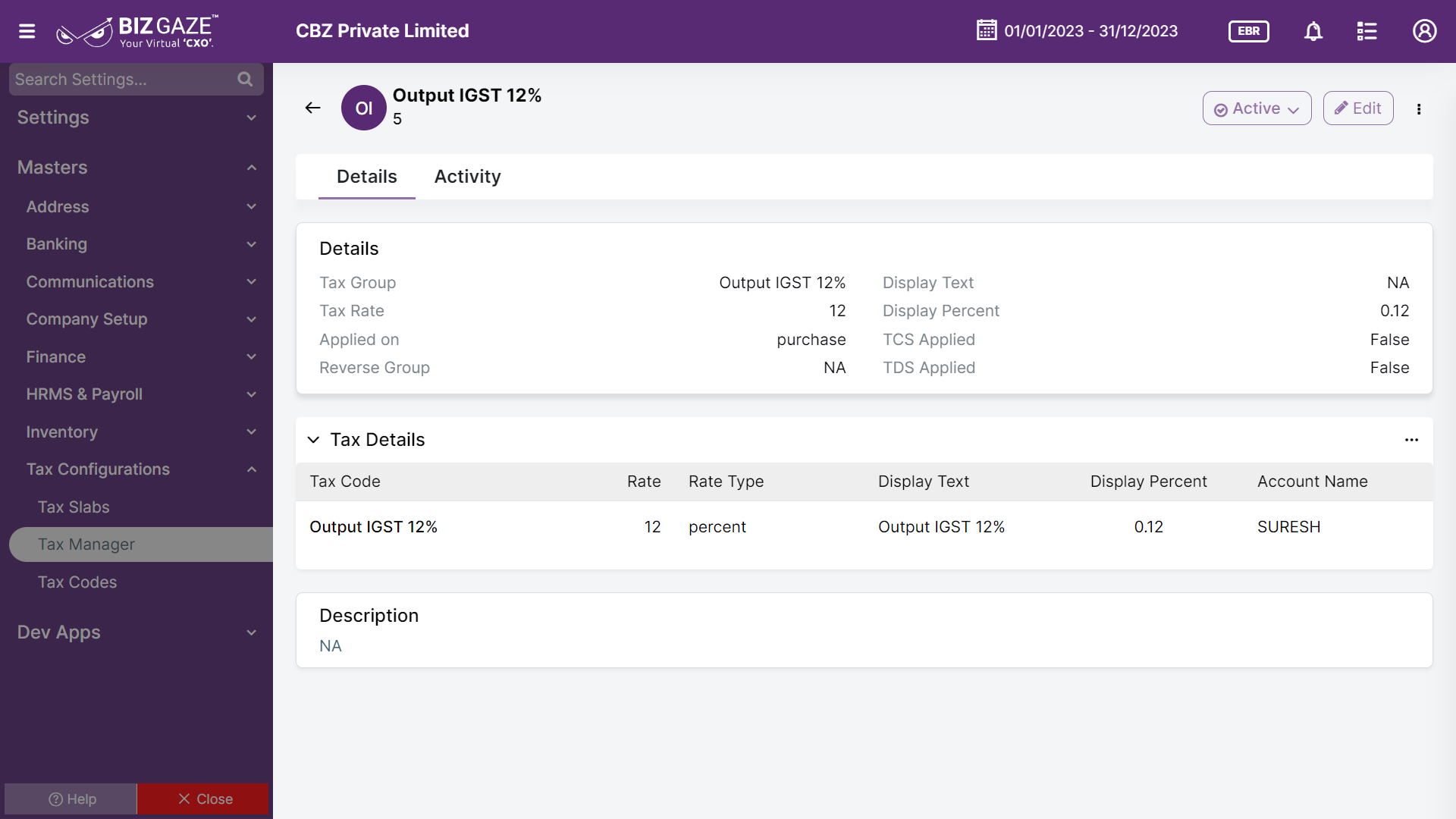

Details

This section contains the details of the taxes applied like Tax group it belongs to, Tax rates, Tax percent, TCS and TDS details of the organization

| Field name | Description |

| Tax Group | Tax group name is displayed. A tax group is a collection of taxes that can be applied as a single set of rules |

| Tax Rate | Displays the Tax rate percent. In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed |

| Display Text | The display text of the tax manager is shown. The text that appears on invoices, receipts, or any relevant documents to indicate the presence of a specific tax |

| Display % | Tax percentage to be added is displayed |

| Applied on | Displays whether the Tax is applied upon purchase or sales |

| Reverse Group | Displays Reverse Tax group name. It means that portion of input tax on the goods for which credit has been availed but such goods are used subsequently for any purpose other than resale or manufacture of taxable goods or execution of works contract or use as container or packing materials within the State |

| TCS Applied | Displays whether TCS is applied or not. Tax collection at source (TCS) is an extra amount collected as tax by a seller of specified goods from the buyer at the time of sale over and above the sale amount and is remitted to the government account. |

| TDS Applied | Displays whether TDS is applied or not. TDS (Tax Deducted at Source) is a deduction made by someone while making a payment or crediting the account |

Tax Details

This widget contains specific information associated with a tax, the relevant data and settings related to a particular tax within the Tax Manager system

| Field name | Description |

| Account Name | Account name of the customer or organization to whom tax is applied. It refers to the name or title assigned to a specific tax account within the Tax Manager |

| Rate Type | Displays whether Tax rate is applied in percentage or any flat value. Rate Type categorizes the type of tax rate applied to a specific tax. It can indicate whether the tax rate is a fixed amount, a percentage of the transaction value |

| Display Text | Text entered to be displayed is shown. The text that appears on invoices, receipts, or any relevant documents to indicate the presence of a specific tax |

| Display Percent | The numerical percentage value that is displayed alongside the tax label or description. It indicates the tax rate as a percentage |

| Rate | Displays the Tax rate percentage applied on the organization |

| Description | Comments or short notes about the Tax rates is displayed. Rate represents the numerical value assigned to a specific tax rate within the Tax Manager |

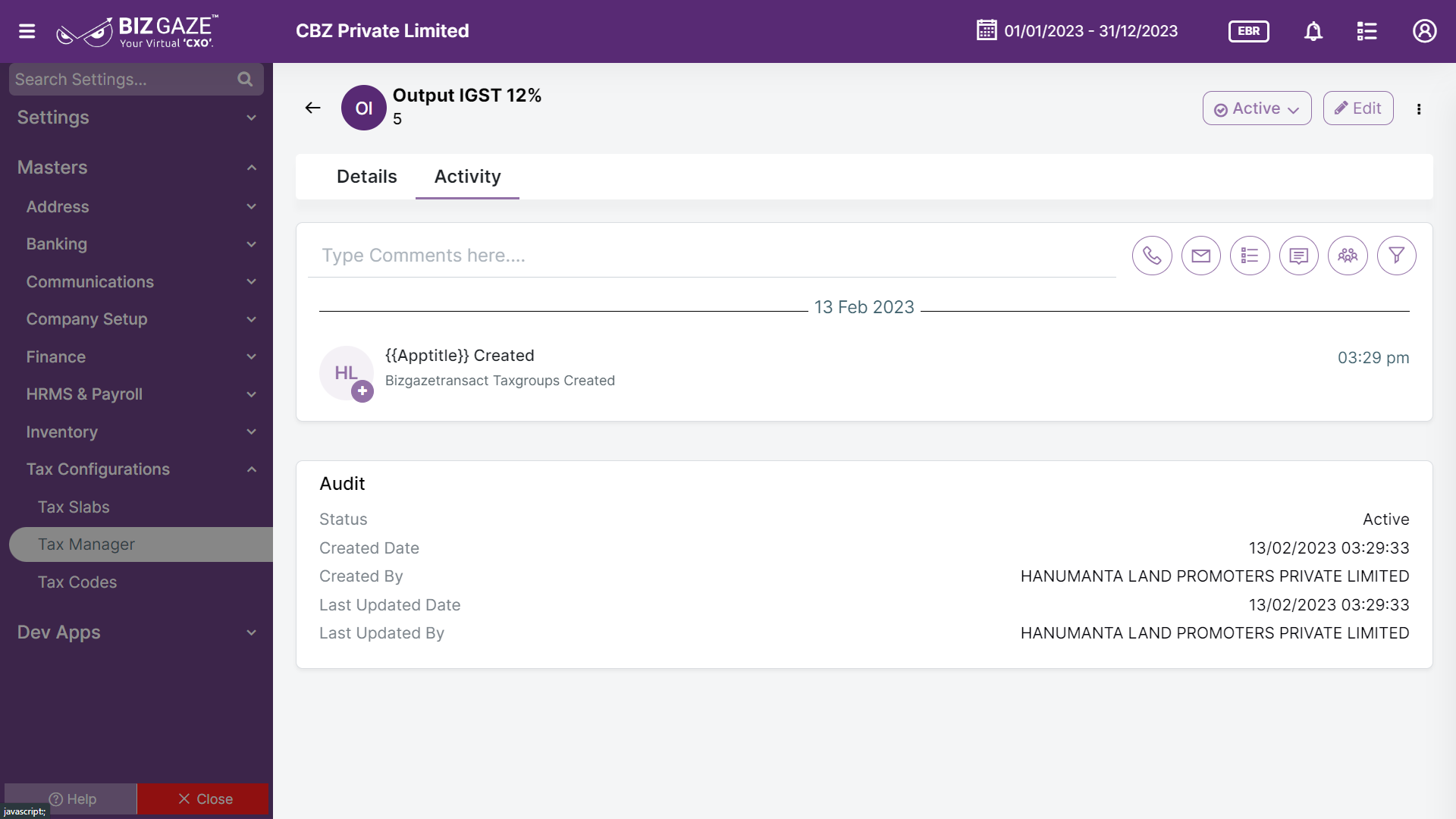

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Activity | |

| Comments | User can write short notes or comments about the Tax manager |

| Audit | |

| Created Date | The date when the Tax manager is created |

| Created By | The name of the person who created the Tax manager |

| Last Updated Date | The last stage changed of the Tax manager |

| Last Updated By | The name of the person who last updated the stage |

| Status | Displays the current status of the Tax manager |

| Time-Line | This widget tracks all the activities within the app. |

Reports

A report is a document that presents information in an organized format for a specific audience and purpose. Although summaries of reports may be delivered orally, complete reports are almost always in the form of written documents.

- Tax Manager Master Configurations