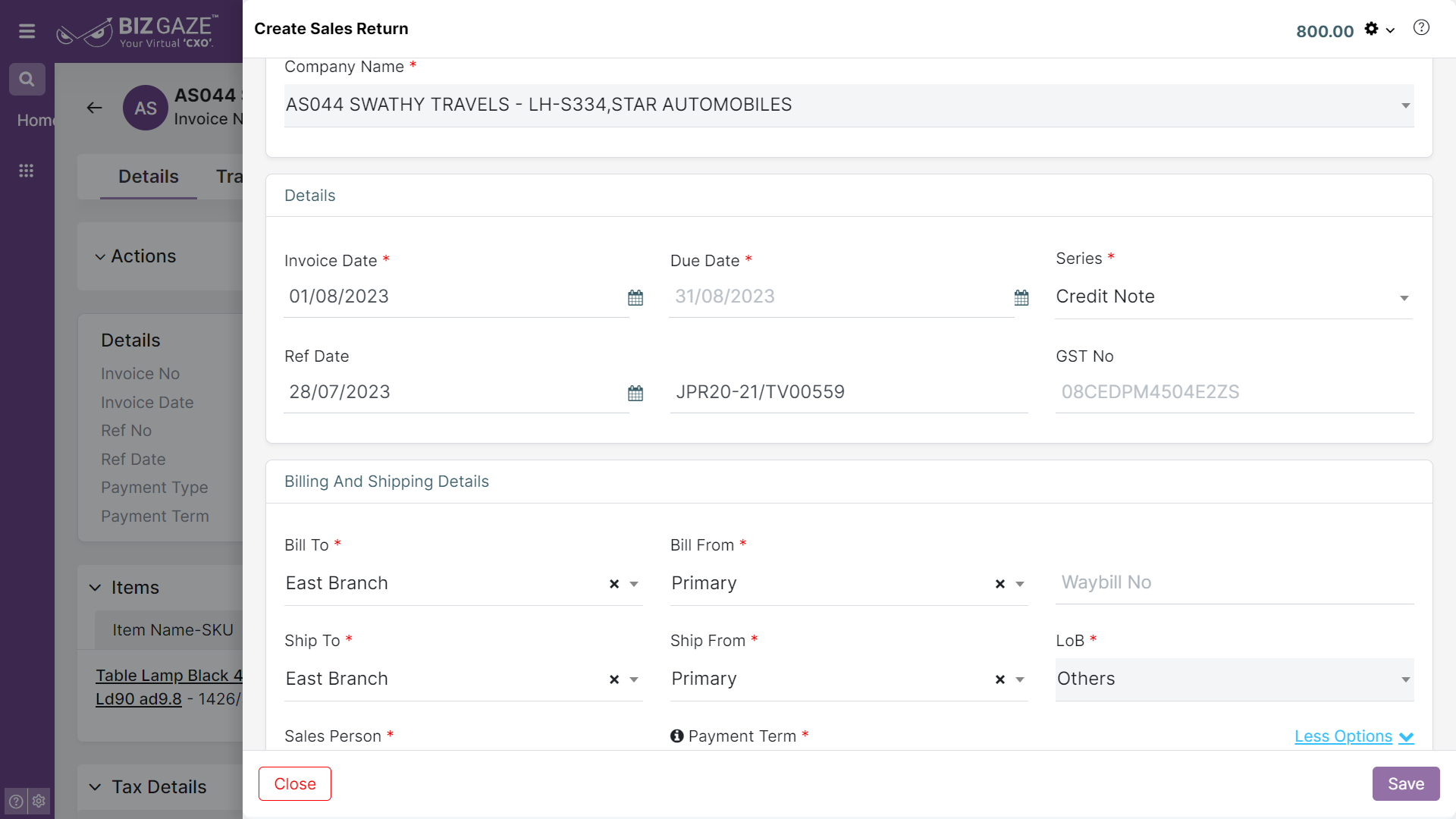

The creation of Sales Return from Sales Invoice App:

Navigation: Menu >> Sales Invoice App >>Sales Invoice Listview >> Select the Sales Invoice in Confirmed stage >> Create Return

The details will automatically load from the invoice and rest of the details are same as create sales return field details

| Field Name | Field Description | Mandatory |

| Company Name | Select the company name from the list. | Yes |

| Details | ||

| Invoice Date | Select the sales return creation date from the calendar. | Yes |

| Series | Select the series from the list for the sales return. | Yes |

| Ref No | The sales invoice number is auto populate as reference number for the sales return | No |

| Ref Date | Select the reference date from the calendar. | No |

| Due Date | Select the due date from the calendar. | No |

| Billing & Shipping Details | ||

| Bill To | Select the “Bill to” address for the customer from the list. | Yes |

| Bill From | Select the “Bill from” address to the customer from the list | Yes |

| GSTIN | The GSTIN number of the customer | – |

| Ship To | Select the “Ship to” address for the customer from the list. | Yes |

| Ship From | Select the “Ship from” address for the customer from the list | Yes |

| EWaybill No | Enter the Ewaybill number manually, if the invoice value is more than Rs. 50,000/-. | Yes |

| LoB | Select the LoB segment for the invoice from the list. | Yes |

| Sales Person | System automatically loads the sales person name, while users can also select from the list manually | Yes |

| Payment Term | Select the payment term for the invoice from the list. | No |

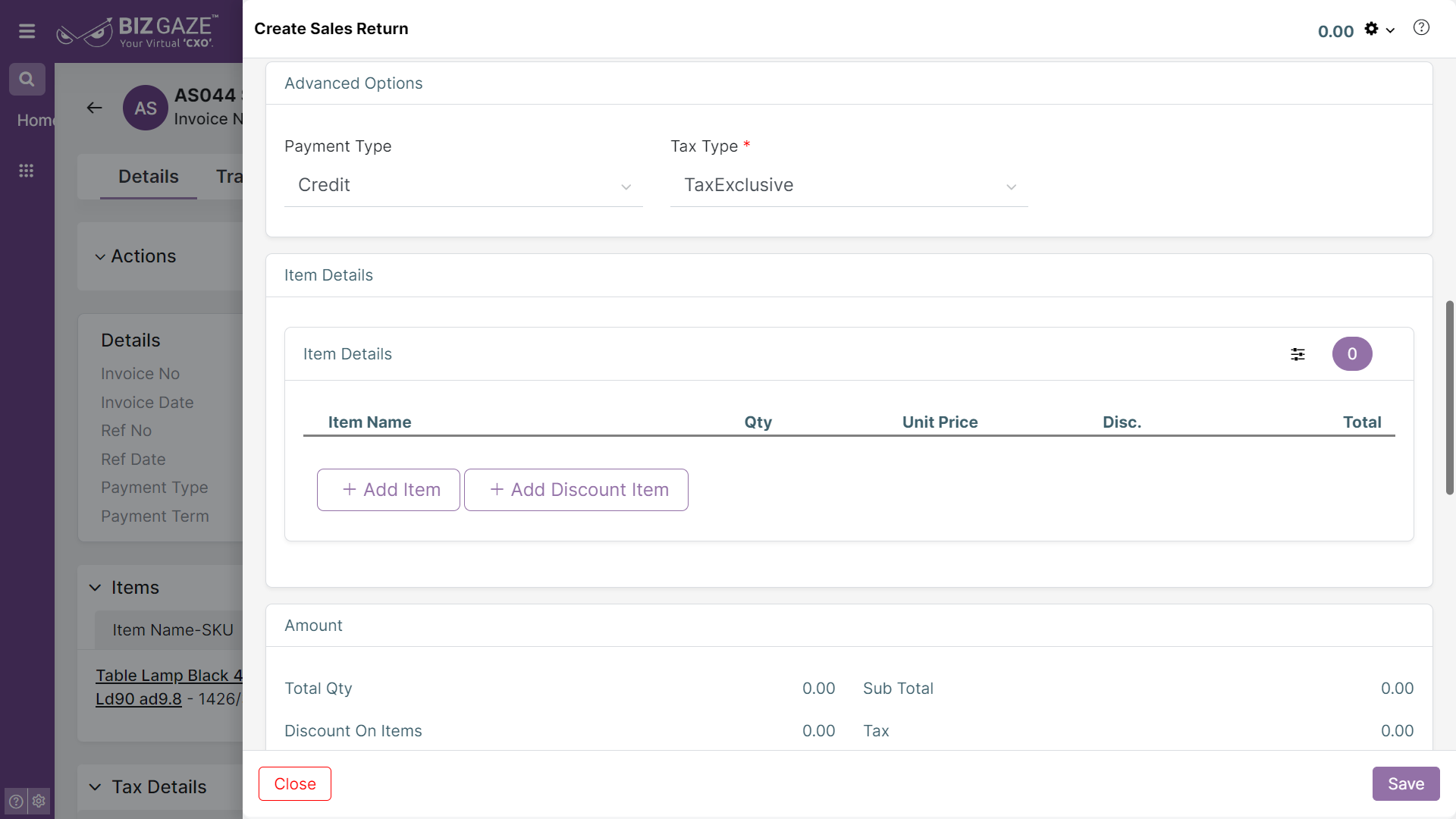

| More Option: When users click on the more option, users can view the Advance Option details. | ||

| Advanced Option | ||

| Payment Type | Select the payment type for the invoice. | – |

| Tax Type | Select the tax type for the invoice. | Yes |

| Item Details | ||

| Add items: Click adds items to select the items | ||

| Select | Select name of the item from the list. | Yes |

| Qty(Quantity) | Enter number of items (quantity) to be returned | Yes |

| Unit Price | Price of item is automatically generated by the system or user can manually enter the value | Yes |

| Disc.(Discount) | Select discount type from the drop-down and enter the value. | No |

| Add Discount Item: Click adds a discount item to select the items | ||

| Select | Select name of the item from the list. | No |

| Description | Enter description for the item. | No |

| Value | Enter value of the item. | No |

| Amount | ||

| Total Qty | Total quantity of the items on the credit note | |

| Sub Total | The value of the item on credit note | |

| Discount On Items | Discount value given on the credit note | |

| Tax | The value of taxes applied on total items | |

| Add Expense | By clicking on add expense, user can view the following fields Select Expense: Select the expense name from the drop down list. Description: Enter the description for the expense. Value: Enter the value of the expense. |

|

| Adjustment | When a user enables the “Adjustment” checkbox, the system automatically adjusts the value to the nearest decimal. If the users click on the checkbox, users can manually enter the values | |

| Account Name (Ledger Name) | Select account name from the list of the ledger account that the value has to be adjusted | Yes |

| Value | Enter the adjusted amount value | Yes |

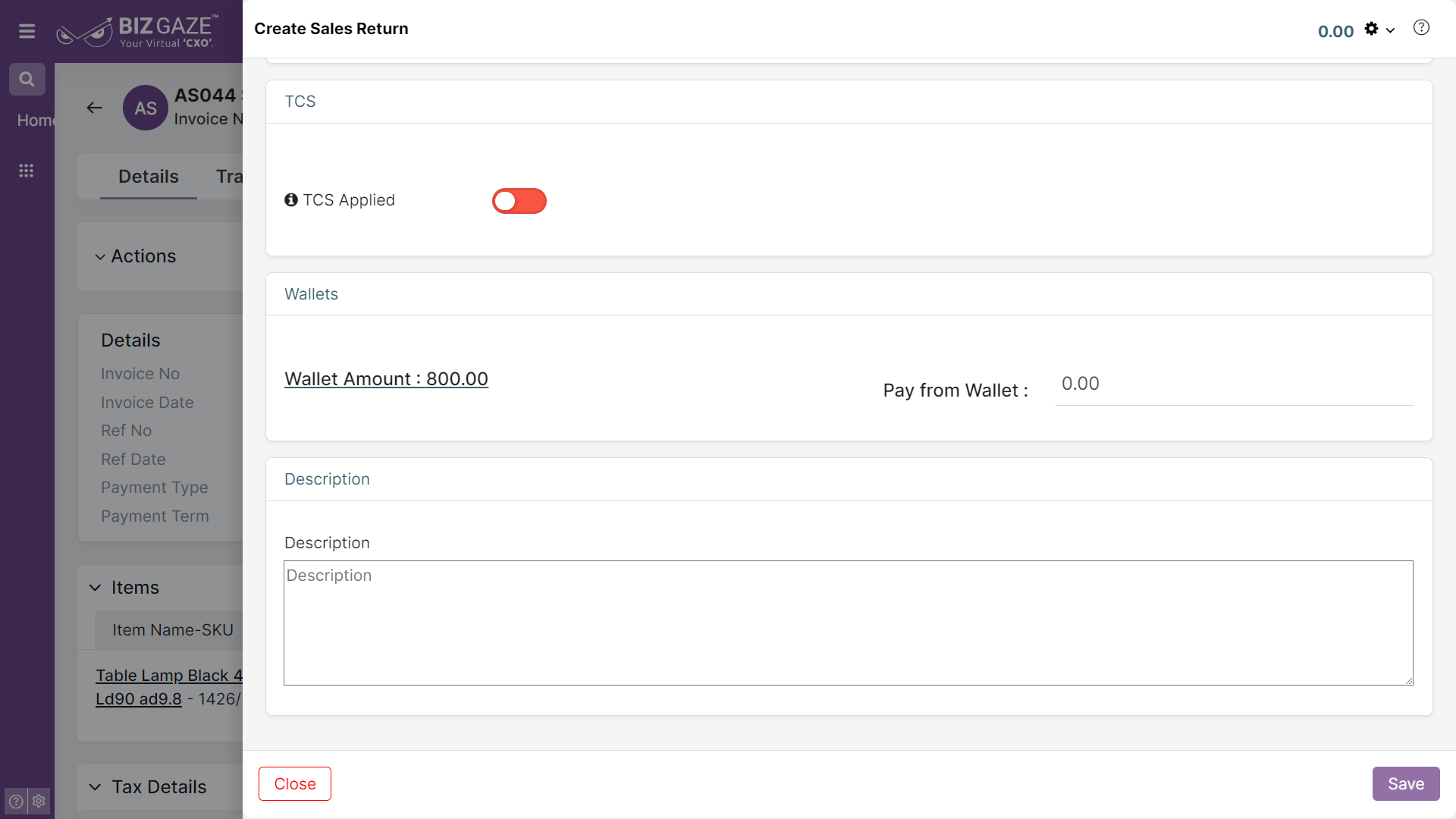

| TCS | |

| TCS Applied | User can click on the Toggle to apply the TCS (Tax Collected at source). The Toggle turns to green in color when enabled and red when disabled. |

| Wallets | |

| Adjustment | By tick mark the check box, the system automatically adjusts the amount to the decimal value or by Opting the check box user can enter manually. |

| Account Name | The user can select the account name from the dropdown list for the adjusted amount. |

Apply all the required details and click on save.