Introduction

A Credit Limit is the amount of unsecured or secured credit that a lender will grant a borrower through a revolving loan vehicle like a credit card, personal line of credit, or a home equity line of credit. BizGaze’s “Credit limit Rule App” allows Lenders to give credit limits based on multiple factors, including the customer’s credit score, other types of credit they have, income, and their on-time payment history. Users can also apply the Credit Limit Rule to certain accounts based on Tags.

Stage Workflow

The default stages workflow in Credit Limit Rule

| Stage Name | Description |

| Active | The Credit Limit Rule is created and processed for further approval |

| Inactive | The Credit Limit Rules waiting for approval |

| Deleted | The Credit Limit Rule is either deleted or nullified |

Portlets & Widgets

In the layout view, a Portlet accurately represents each functionality, and its corresponding data is precisely viewed as a Widget. The following section includes the default portlets and widgets of the Credit Limit Rules App.

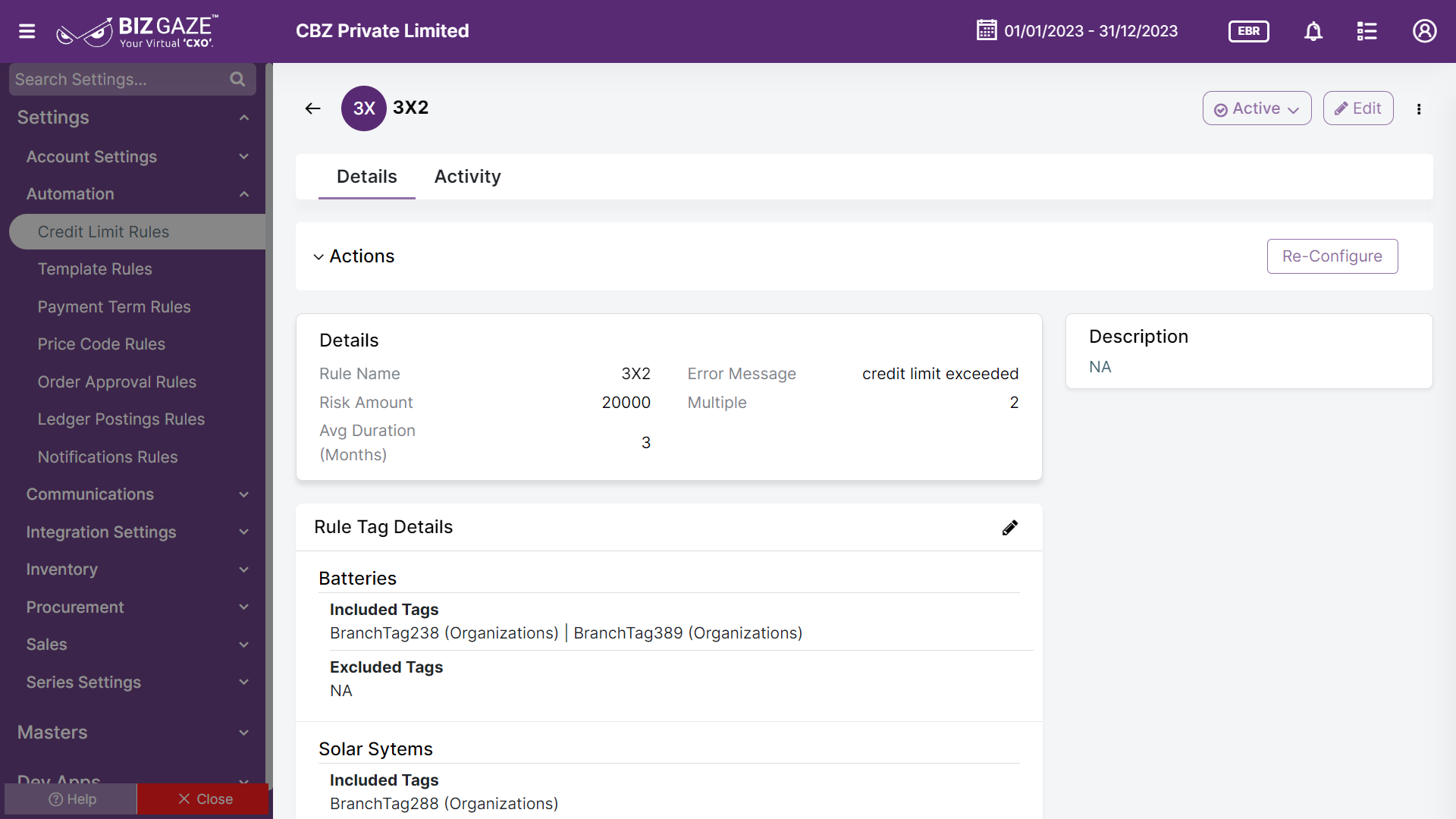

Details

This section contains details about Tags, Rule Tag details, Included contacts, and Excluded contacts of the Credit Limit Rule

| Field name | Description |

| Rule name | Credit limit rule name is displayed. The rule name typically provides a brief description of the purpose or criteria of the rule. These names would be used to identify the specific rules and conditions that must be met before a Sales order can be approved or a customer can be added to the system. |

| Avg duration (Months) | Displays the average duration period of the Credit Limit Rule (In months. It refers to the average time it takes for a customer to settle their outstanding payments or debts. |

| Risk amount | The “risk amount” is an organization’s potential financial loss from a transaction or business activity. It is calculated based on transaction size, customer creditworthiness, and past experiences. Companies use this to determine the appropriate credit limit for customers or identify high-risk transactions that need review. |

| Error message | The system automatically displays the error message. Error message refers to the notification or alert displayed when a Credit Limit Rule is violated or not met by a customer. |

| Multiple | By giving the multiple factor system automatically sets the credit amount for the customer with multiplying the Risk amount & Avg duration months. |

| Description | Comments or short notes about the Credit Limit Rule are displayed |

Rule Tag Details

Approval rules can also be applied to customers based on the Customer Line Of Business tags. This section contains and displays the tag details included or excluded from the Credit Rule Limit.

| Field name | Description |

| Included tags | Displays Tags that are included in the Credit Limit Rule so that the customers will get included with respect to the tag included. |

| Excluded tags | Displays the tags that are excluded from the Credit limit Rule so that the customers will not get included with respect to the tag excluded |

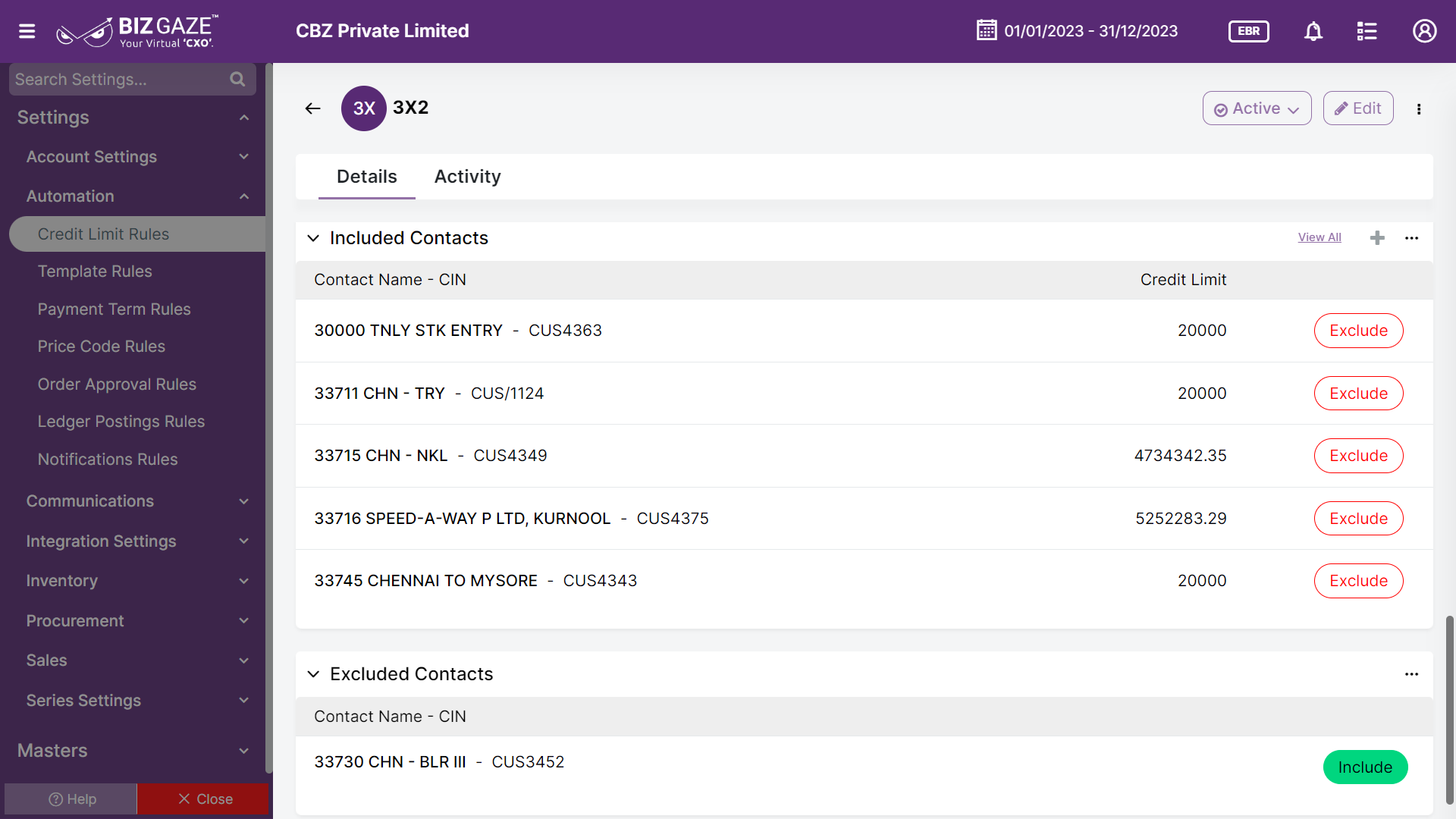

Included Contacts

This widget contains the contacts that are included based on the customer Tags. Particular tags can be selected to apply the Credit Limit rule so that the customers will get included with respect to the tag included.

| Field name | Description |

| Contact Name | The system displays the contact name included based on their tags. |

| CIN | CIN number of the Included contact is displayed. CIN is the Corporate Identification number allotted to all registered companies under ROC. |

| LoB | Line of Business segment tag assigned for the contact is displayed. A business segment can be identified by the product(s) sold or services provided or by geographical locations that the company operates in. |

Excluded Contacts

Particular tags can be selected to revoke the Credit Limit rule so that the customers will not get included with respect to the tag excluded

| Field name | Description |

| Contact Name | The system displays the contact name that is not included based on their tags |

| CIN | CIN number of the excluded contact is displayed. CIN is the Corporate Identification number allotted to all registered companies under ROC. |

| LoB | Line of Business segment tag assigned for the contact is displayed. A business segment can be identified by the product(s) sold or services provided or by geographical locations that the company operates in. |

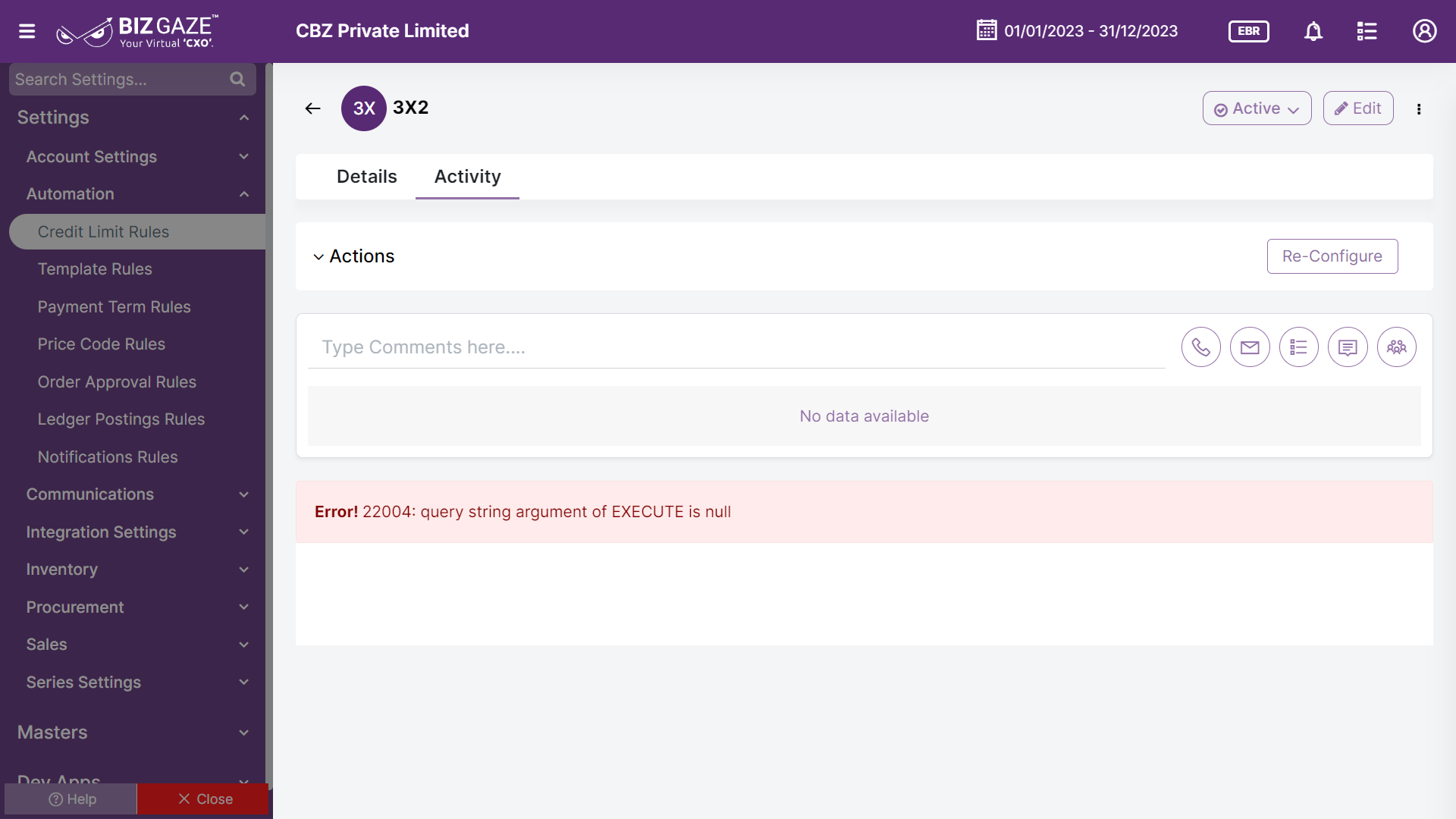

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Comments | User can write short notes or comments about the Credit Limit Rule |

| Audit | |

| Created Date | The date when the Credit Limit Rule is created |

| Created By | The name of the person who created the Credit Limit Rule |

| Last Updated Date | The last stage changed of the Credit Limit Rule |

| Last Updated By | The name of the person who last updated the stage |

| Status | Displays the current status of the Credit Limit Rule |

| Time-Line | This widget tracks all the activities within the app. |

Reports

A report is a document that presents information in an organized format for a specific audience and purpose. Although summaries of reports may be delivered orally, complete reports are almost always in the form of written documents.

- Credit Limit Rule Master