Introduction

A credit note is a legal document issued by a supplier to the buyer. This document serves as an acknowledgement that the buyer’s account has to be credited with a certain amount. In case, if the buyer is not satisfied with the quality of products, or there is any discrepancy in the price of goods/ services in the invoice, or the tax charged in the invoice exceeds the tax payable, then the buyer shall return the goods/services to the supplier. In return, the supplier issues a credit note to the buyer to notify him that the goods/services returned have been recorded (return inwards) and credit is being extended for it.

Stage Workflow

The default stages of the Credit Notes app are

| Stage Name | Stage Description |

| Draft | The credit note is generated but not submitted. |

| Active | The credit note is submitted but not yet approved. |

| Confirmed | The credit note is approved. |

| Partially Paid | The amount is partially paid by the seller. |

| Paid | The amount is fully paid by the seller. |

| Void | The credit note is deleted or rejected by the manager. |

Portlets & Widgets

In the layout view, a Portlet accurately represents each functionality, and its corresponding data is precisely viewed as a Widget. The following section includes the default portlets and widgets of the Credit Notes App.

This section contains the Tax details, item details, Credit Note value summary, billing address, and shipping address

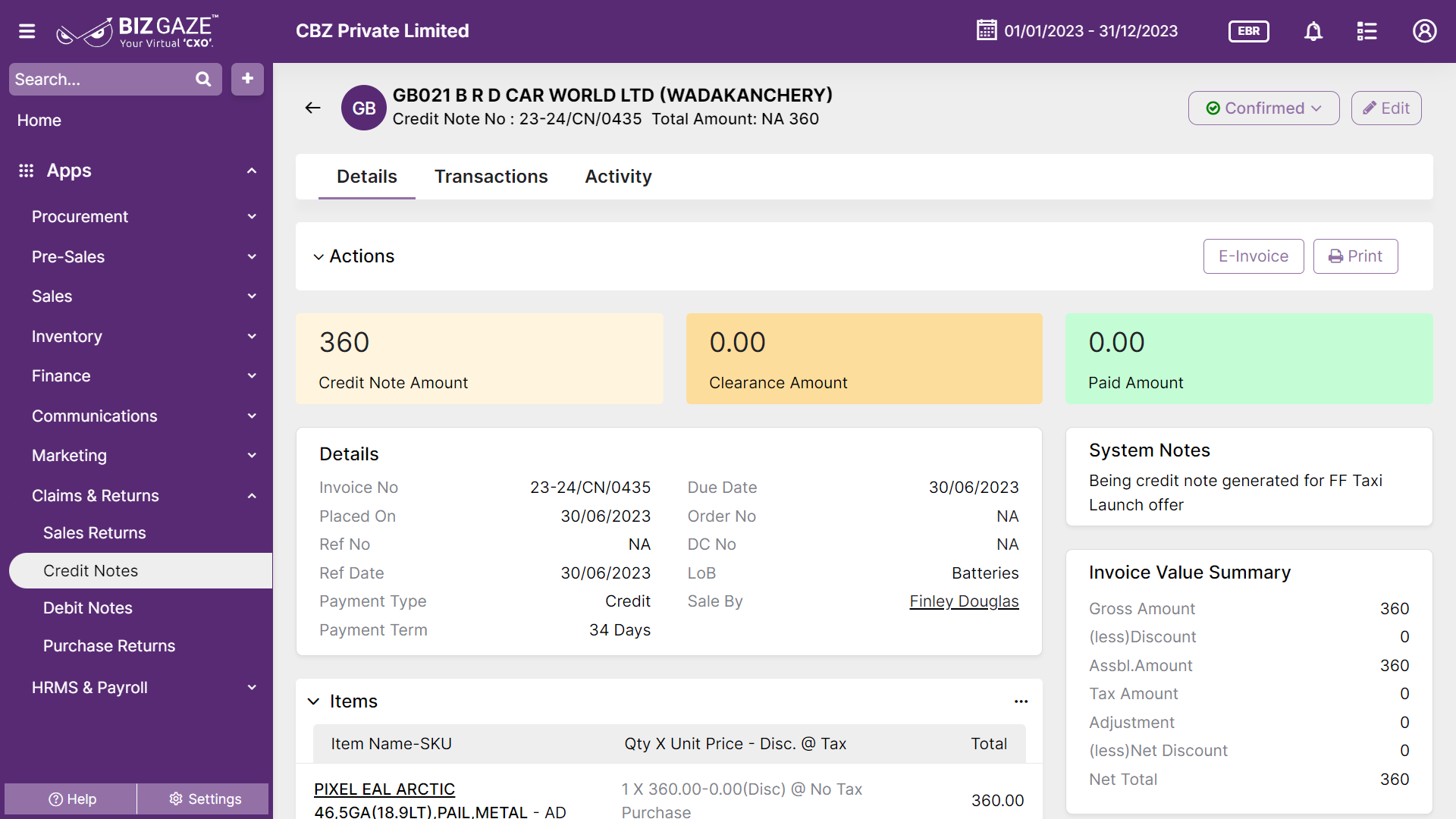

Credit Note Details

This Widget contains Credit Note details such as the name of the seller and the buyer, the date of issue, the reason for issuing the credit note, the original invoice number, and the amount of the credit.

| Field name | Description |

| Credit Note no. | A Credit Note number is a unique identifier assigned to a Credit Note that helps to track and manage the transaction. It refers to the system generated series for the Credit Note. |

| Placed on | It refers to the date when the Credit Note is created. It is important for tracking purposes and helps determine the expected delivery timeline |

| Due date | It refers to the date by which a payment is required to be made to a creditor or supplier. It is the deadline for payment, and failure to make payment by this date may result in late fees, penalties, or other consequences. |

| Ref no | Ref No refers to the unique identification number generated by default for which Credit Note is created. |

| Ref date | Displays the reference date of the Credit Note that helps in quick identification |

| LoB | LoB refers to the specific industry segment or product category associated with the transaction. It is useful for managing and tracking sales data and inventory related to different product lines or divisions within a company. |

| Payment type | Displays payment mode of the transaction. Payment type refers to the method the customer makes payment for the goods or services received like cash, credit, debit, bank transfers, or digital wallets. |

| Payment term |

1.Payment term refers to Specific term of days or Period for which the Invoice due to be cleared. If the Payment Term Exceeds penalties/ Discount can be applied for Late & early Payments 2.User can select the payment term manually or will be loaded by default based on the Payment Term rules Configured |

| Created By | Displays the name of the user who created the Credit Note. It refers to the individual or entity responsible for initiating and completing the Credit Note. |

| Field name | Description |

| Credit Note Amount | It is the total value of the Credit Note, which represents the amount that the seller owes the buyer as a result of the Credit Note. The Credit Note amount can be equal to or less than the original invoice amount, depending on the reason for issuing the Credit Note. |

| Paid Amount | The amount that the buyer has already paid to the seller for the original invoice before the Credit Note was issued. The paid amount is deducted from the clearance amount to determine the remaining amount that the buyer owes the seller after the credit note has been applied. |

| Clearance Amt | This refers to the amount that the buyer owes the seller after the credit note has been applied to the original invoice. It is calculated by subtracting the credit note amount from the original invoice amount. The clearance amount represents the final amount that the buyer is required to pay to the seller. |

Credit Note Value summary

A Credit Note value summary provides a comprehensive overview of the total cost of the order, including all the items purchased, their individual costs, and any additional charges such as taxes, discounts, and shipping fees.

| Field name | Description |

| Gross Amount | Gross Amount refers to the total amount of money or value of a transaction before any deductions or expenses are taken into account. It includes all charges, fees, taxes, and other costs associated with the transaction. |

| Discount | Total discount value given on the item. The “Discount on Items” value is loaded automatically. |

| Total Tax amount | Total Tax Amount refers to the sum of all taxes that are applicable to a transaction or purchase. |

| Assebl. amount | Assessable Amount refers to the before tax and after discount amount. |

| TCS amount | TCS amount applied is displayed. Tax Collected at Source (TCS) is a tax payable by a seller which he collects from the buyer at the time of sale of goods. |

| Adjustment | Adjustment amounts made from the wallets |

| Net Total | Net Total refers to the final amount that remains after all deductions, discounts, taxes, and other charges have been subtracted from the Gross Amount. It is the actual amount that a customer is required to pay for a product |

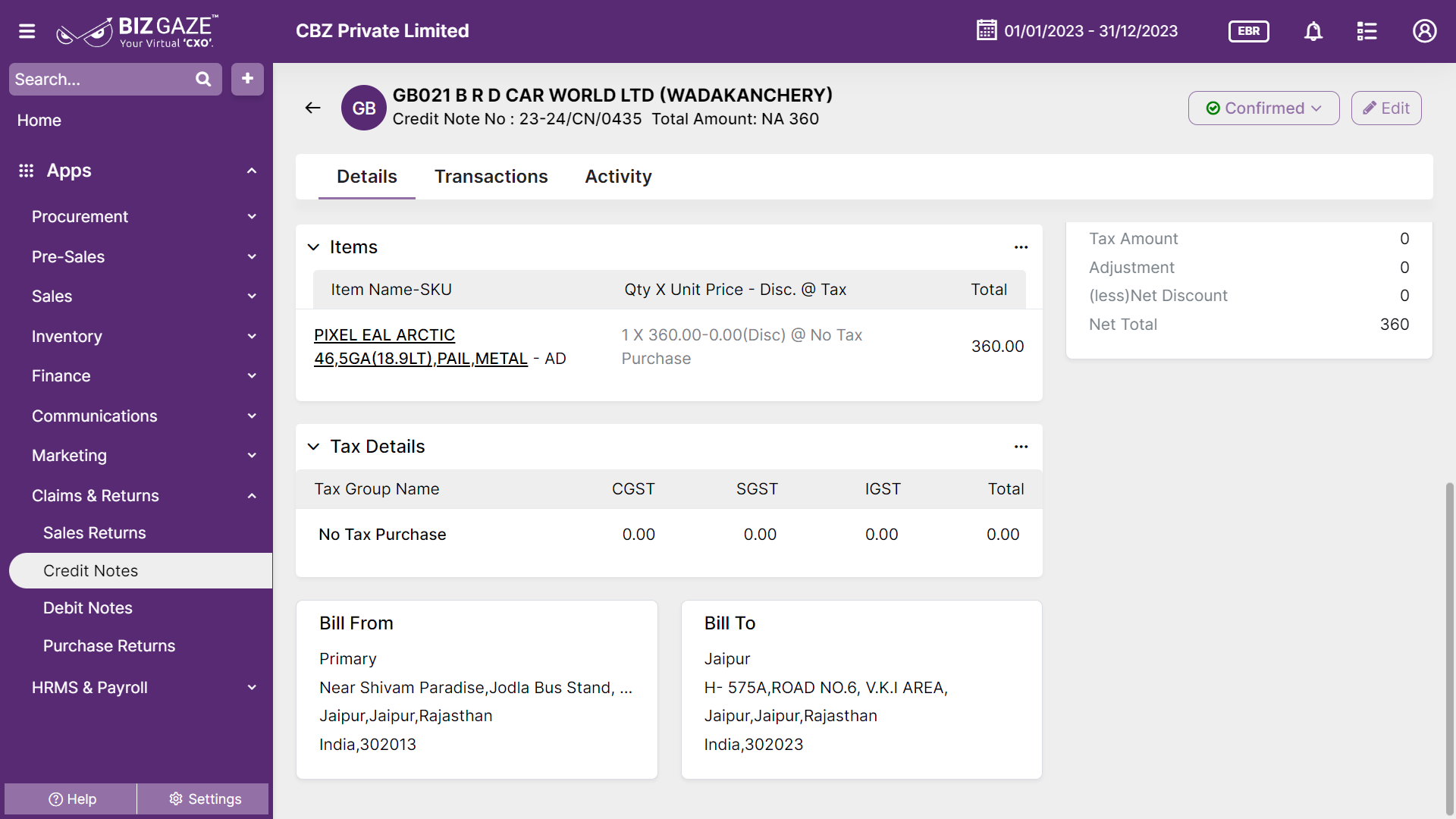

Items

Item section contains details about the items that are returned, which means that the item was returned back to the person who has shipped the product. This widget shows the Items with Qty, Price, Discount & Tax selected to create the Return

| Field name | Description |

| Item name | Item name refers to the name or title of a product, service, or item that is being offered for sale or purchase. It is typically used to describe the product or item in a concise and clear manner, so that customers can easily understand what it is and what it does. |

| SKU | Displays SKU code of the item. A SKU, which stands for Stock Keeping Unit, is a unique identifier for each of the products that makes it easier to track inventory |

| Quantity | Quantity refers to the numerical value that represents the number of items, products, or units that are being purchased or sold in a transaction. It is the total number of units of a product or service that a customer is ordering or a seller is providing. |

Tax details

Tax details refer to the information related to taxes that are applied to a transaction, such as the sale of goods or services. Tax details are usually included in invoices or other financial documents to ensure proper calculation, reporting, and payment of taxes as required by law.

This widget shows the Tax calculated for the Items in Credit Notes

| Field name | Description |

| Tax Group name | Tax group name is displayed. A tax group facilitates collecting more than one set of taxes under a single set of rules. |

| CGST | Displays CGST (Central Goods and Services Tax) tax amount on the invoice. The GST to be levied by the Centre on Intra state supply of goods and / or services is Central GST (CGST) |

| SGST | Tax amount of SGST (State Goods and Services Tax) in the invoice. The GST to be levied by the State on Intra state supply of goods and / or services is State GST (SGST) |

| IGST | IGST (Integrated Goods and Services Tax) tax amount added in the invoice is displayed. On supply of goods and services outside the state, Integrated GST (IGST) will be collected by Centre. |

Billing and shipping address

| Field name | Description |

| Bill To | Billing Address refers to the address where a customer receives their billing statements or invoices for goods or services they have purchased. |

| Ship To | Ship To address refers to the physical location where a package or item is intended to be delivered. It typically includes the recipient’s name, street address, apartment or unit number (if applicable), city, state or province, zip or postal code, and country |

| Bill From | Sold By refers to the entity or business that is offering a product or service for sale. It could be the manufacturer, distributor, retailer, or a third-party seller. |

| Ship From | Ship from refers to the location or origin from where a product or package is being shipped or sent to its destination. It is the physical address or location where the product is being dispatched from. |

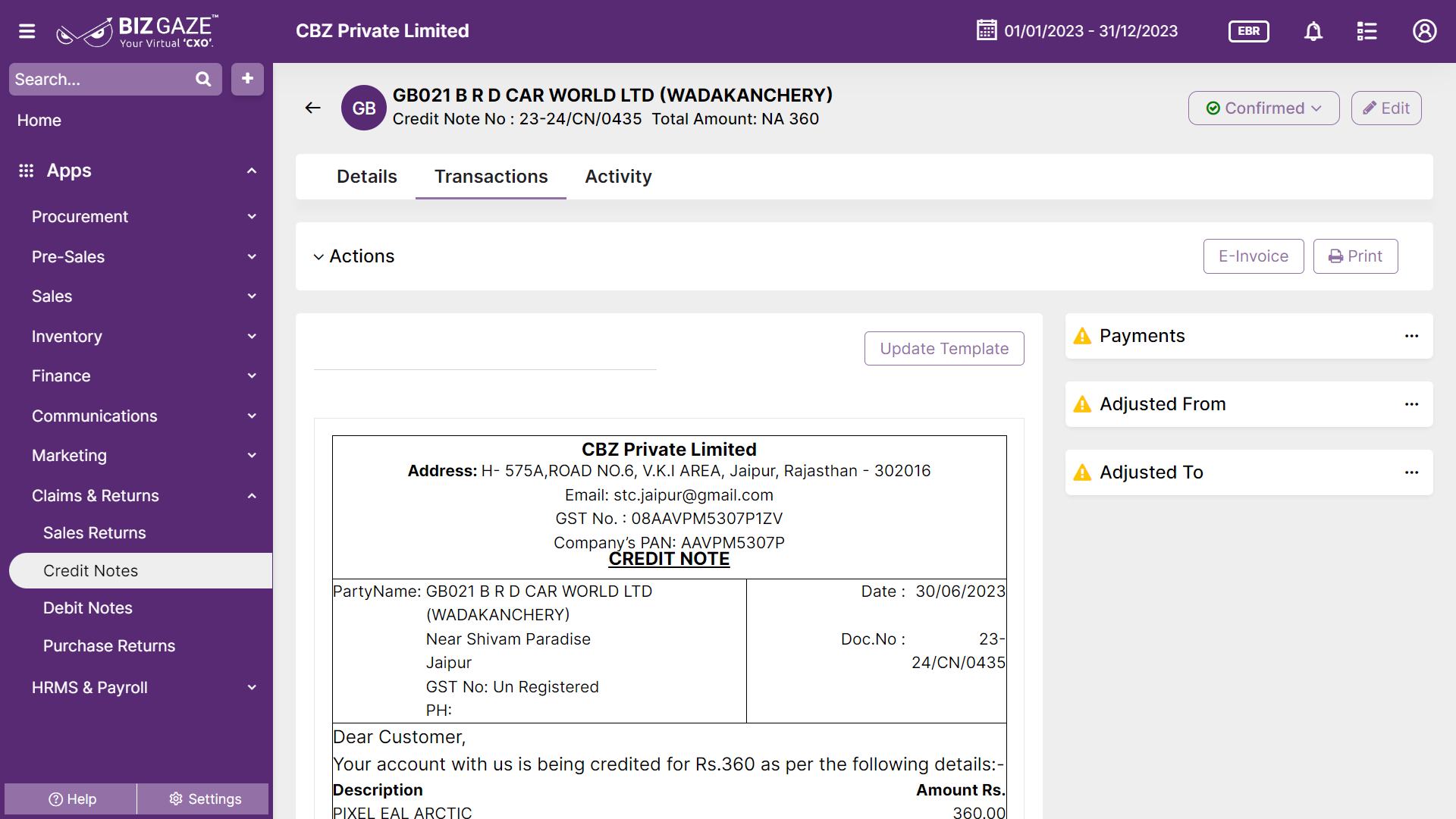

This section contains transaction details of the Credit Note created. A transaction is an event or action that involves the exchange of goods, services, or financial assets between two or more parties.

Payments

Details related to payments in Credit Note like payment number, payment date, total amount, payment mode and total invoice amount are displayed.

Adjusted From & Adjusted To

| Field name | Description |

| Adjusted From | This widget shows the Amount from which the Payment amount is adjusted in invoices (From the wallets amount can be adjusted to invoices) |

| Adjusted To | This widget shows the Payment amount that is adjusted with respect to the Invoices. |

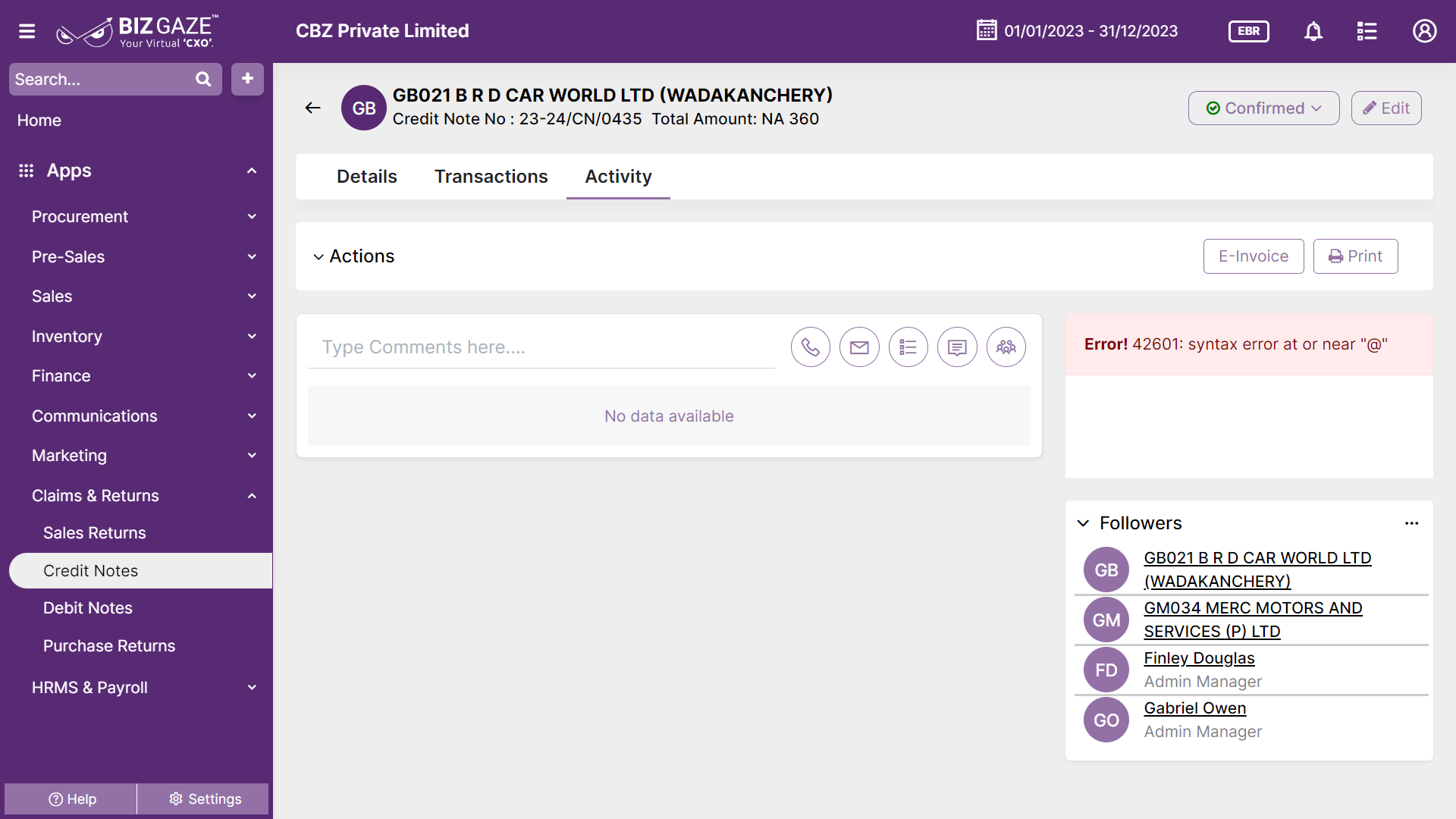

Activity

Activity Log provide users with essential information, notifications, and real-time updates to keep them engaged and informed about key activities in apps related to updates, notifications, and stage changes.

| Field name | Field Description |

| Comments | User can write short notes or comments about the Credit Note |

| Audit | |

| Created Date | The date when the Credit Note is created |

| Created By | The name of the person who created the Credit Note |

| Last Updated Date | The last stage changed of the Credit Note |

| Last Updated By | The name of the person who last updated the stage |

| Status | Displays the current status of the Credit Note |

| Time-Line | This widget tracks all the activities within the app. |

Reports

A report is a document that presents information in an organized format for a specific audience and purpose. Although summaries of reports may be delivered orally, complete reports are almost always in the form of written documents

- Credit Note Master